Well, a decent month in the books considering:

- Tax Payments sent in.

- Barely positive investment performance.

- Purchased air tickets for friend's wedding (~$400.00)

- Paid off car loan.

Upcoming expenses:

- One more airline ticket. (~$600.00)

- New wireless phone.

Interesting notes this month:

- 6 month CD maturing (4.00%)

- Re-allocate investments.

-- Shift funds from CD to investment account.

I have to do a bit of traveling since my good friend's wedding is coming up. I need to really think through my asset allocations...

Well, a decent month in the books considering:

- Tax Payments sent in.

- Barely positive investment performance.

- Purchased air tickets for friend's wedding (~$400.00)

- Paid off car loan.

Upcoming expenses:

- One more airline ticket. (~$600.00)

- New wireless phone.

Interesting notes this month:

- 6 month CD maturing (4.00%)

- Re-allocate investments.

-- Shift funds from CD to investment account.

I have to do a bit of traveling since my good friend's wedding is coming up. I need to really think through my asset allocations...

Sunday, April 30, 2006

04.2006 Net Worth [+$4,977.55, +2.68%]

Well, a decent month in the books considering:

- Tax Payments sent in.

- Barely positive investment performance.

- Purchased air tickets for friend's wedding (~$400.00)

- Paid off car loan.

Upcoming expenses:

- One more airline ticket. (~$600.00)

- New wireless phone.

Interesting notes this month:

- 6 month CD maturing (4.00%)

- Re-allocate investments.

-- Shift funds from CD to investment account.

I have to do a bit of traveling since my good friend's wedding is coming up. I need to really think through my asset allocations...

Well, a decent month in the books considering:

- Tax Payments sent in.

- Barely positive investment performance.

- Purchased air tickets for friend's wedding (~$400.00)

- Paid off car loan.

Upcoming expenses:

- One more airline ticket. (~$600.00)

- New wireless phone.

Interesting notes this month:

- 6 month CD maturing (4.00%)

- Re-allocate investments.

-- Shift funds from CD to investment account.

I have to do a bit of traveling since my good friend's wedding is coming up. I need to really think through my asset allocations...

Saturday, April 29, 2006

Free Software You Must Use. That's Right MUST Use.

Okay, not must use, but I really, really recommend them. They are great applications. I'm a Windows user, so my recommendations are for Windows apps. Some versions maybe available for Linux and MacOS, but I'm not sure...

Password Corral

I've been using this app since 1996. Actually, I'm not really sure when I started using Password Corral, but it's been awhile...I have passwords recorded from waaaaay back.

Irfanview

Hands down the BEST free imaging tool. Of course, it's user interface could stand for some improvement, but the features make it well worth it.

EZ Antivirus by Computer Associates

Sure you could spend $40.00 a year on Nortan or McAffee, but I prefer free. On top of that, I try to becareful when viewing emails and documents, so my anti-virus app is really just an extra level of protection. I actually ran without one for over 2 years before installing EZ Antivirus last November.

Okay, everybody hates Spyware. If you're a fan, let me know...You would be the first person I've met that likes it. Unlike viruses, Spyware can mutate and "live" in your environment in multiple ways...often being more invasive then viruses since they are actual applications that run on your computer, versus viruses which find holes in applications. If you want a really clean environment, don't install odd software! If it's looks shady, don't install it...But if you've already installed music swapping software, free games, etc. then you need to run:

Microsoft Defender (Beta 2)

Spybot - Search & Destroy

Ad-aware

These 3 tools should clean out most Spyware. Yes, you should run all 3 of them. Why? Because they often detect different spyware apps. I strongly recommend Microsoft's Defender...it offers real-time protection, which means that it'll tell you right away that some suspicious activity is happening on your computer.

All right, so let's say you've run all 3, and you STILL have some funky windows popping up on your system. Well, now it's time to call in the calvary. Properly used, this tool will help get rid of any bad stuff on your computer. It'll let you dig deep into the details of Windows.

HijackThis. Don't let the novice looking webpage scare you. This is the Swiss Army knife of system tools. Not recommended for the faint of heart, this tool can be extremely useful and cause irrepairable damage if not used correctly.

Let me know if you have any questions.

Check out John's list @ Might Bargain Hunters.

Friday, April 28, 2006

Updated Doggie Costs 04.28.2006

So I spoil my little boy. Actually, today I think I am justified to spoil him...He was neutered and microchipped. Poor guy. It's for the best though, for me and him. If it adds a couple of years to his life and makes him more sociable to other dogs/people, it's all worth it.

Hold your breath, $220.77 for microchipping, treats, a couple toys, leash, antibiotics, and flea medicine (almost ~$90.00! for 6 months).

Total to date: $3,992.79

Here's the full post of Brownie's cost to date.

Friday! Update: Soul For Sale, AI, and Pet Insurance 04.28.2006

Woot $65 bonus cash has been funded to my Sharebuilder account. I must say, I've been happily impressed with Sharebuilder, especially with the email notifications they provide throughout the process of opening your account. Everytime I had a question, like, "hmm, I wonder if I qualified for the Costco $65 bonus?" I would get an email shortly after saying, "You're qualified and will be credited $65." Nice. Thanks to Jonathan @ MyMoneyBlog for the introduction to Sharebuilder.

Just to recap this week, Brownie has been insured. Vet costs for our furry, and sometimes non-furry, friends can add up quickly. It gives me peace of mind that I can give Brownie the best care regardless of my financial situation at the moment.

I'm still smoke free! You know, I'm starting to realize that certain things that I do bring the urge back...for example, just the other day I went fishing...The urge to smoke was stronger than ever! I didn't, but still. Worse my friend and I have this thing, every fish we catch, means one cig. We need a new "thing," and I guess I have to force my mind to dissociate fishing with smoking.

I'm also looking to purchase a home in a year or so...I found City Girl wrote up a great post on soul searching to figure out why you want a house. It's a great read, check it out!

Speaking of houses, congrats to fivecentnickel and SingleMa on their home purchases!

John @ Mighty Bargain Hunter has a great discussion on education. It's important to think about your education and what you expect to get from it. Just like buying a house, I believe you really need to ask yourself why you want to get a degree in abc field. Is it the money? Is it the glamour? Or something else? It's not like you want to spend 4 years of your life getting a degree only to realize you don't like it. Of course, each journey we take is our own unique journey, but you probably don't want to travel down the same path too many times ;). Especially since it's not only time but hardwork and money! Makingourway discusses the money part and who he feels should pay. One day I hope to go back to school.

Since it's the weekend, I don't want to leave you thinking about something as serious as education or the 990 posts on PFBlogs.org about gas prices since a little pain does us good, rather I want to leave you with an important question to ponder about "Why is American Idol so popular?" Hah. And buy him a beer while you're there! That's funny.

Have a great weekend everyone!

Thursday, April 27, 2006

Sweet 16. Spoiled 16 More Like It.

I'll admit it, MTV is part of my generation's lifestyle. From "the Real World" to "Beavis and Butthead," MTV affects the younger generation, like it or not.

A few shows like "True Life" and...uhh, and "True Life" actually do something good for society. Everything else is well, just crap IMHO. Wait, I'll admit MTV's Boiling Point is a show I watched on occassion for a laugh, but that's it. There is one show out of all of them, even more so than "Date My Mom" or "Punk'd" that irritates the heck out of me and that show is "My Sweet 16," which they have recently renamed to "My

I'll admit it, MTV is part of my generation's lifestyle. From "the Real World" to "Beavis and Butthead," MTV affects the younger generation, like it or not.

A few shows like "True Life" and...uhh, and "True Life" actually do something good for society. Everything else is well, just crap IMHO. Wait, I'll admit MTV's Boiling Point is a show I watched on occassion for a laugh, but that's it. There is one show out of all of them, even more so than "Date My Mom" or "Punk'd" that irritates the heck out of me and that show is "My Sweet 16," which they have recently renamed to "My My Super Sweet 16 takes you on a wild ride behind the scenes for all the drama, surprises and over-the-top fun as teens prepare for their most important coming-of-age celebrations.Most important coming-of-age celebrations? What normal 16 year old has a huge party that costs over $150,000.00? If it was the most important, I feel sorry for the majority of 16 year olds that never see this. And forget college, because this party would be much more of a financial burden than the minor point of COLLEGE. It lives up to all the stereotypes of being rich, conceited, selfish, and totally disconnected from the real world, no pun intended. Chrees' talks about an article on her blog...what should be an April Fools article is real. I can't believe it. These parents are actually proud to show off their kids like this? Wow. I thought I wasn't going to write anything today, but Chrees' post hit a nerve. Any naysayers claim jealousy, really I am not jealous of being thought of as snooty idiots. So yeah, I'm jealous...hah. /rant

Off Topic: Have Faith! A Dog Born With Only 2 Legs.

A dog that was born with only 2 working legs that was almost put to sleep, learns to walk like a human! It's pretty neat. Check it out here.

Not much going on in the blogging section of my head today, so I'm probably not going to post anything else today. See ya tomorrow.

Wednesday, April 26, 2006

Are You a Tease Shopper? How About a Value Shopper?

I'm a tease shopper. I go into a store, look around. I have a couple things I need...shaving gel, some pens, and maybe a magazine. I spend hours deciding between two or three different brands, comparing value, features, smell, ingredients if it's food, quality, etc. etc. etc. I then find a few things that I've "wanted," but don't really need...put them in my basket or cart. I proceed to look around. Finally, I approach the cash register and pull a 360. I put back 50% of what I don't need. I even go back and compare brands of shaving gel again, even though I always use the same one. People give me weird looks. But I feel good leaving the store with only the things I need. I'm a tease.

I'm also a a value shopper. This applies more to supermarket shopping. I go into a store, and only buy things on sale. I rarely buy stuff that isn't. I don't know why. I just can't get myself to buy something at regular price. I like seeing "SALE" next to each item on my receipt...I feel like I won something. Then at the bottom it says, "You saved $xx.xx." I always try to make this value bigger than the amount I actually spent...I've done it a few times, but it's not easy. Oh, and I love the surprise sale / price error items! Like finding money in my pocket.

My two value shopping goals:

1. All items with "SALE" next to it.

2. My saved amount greater than my paid amount.

I'm a value shopper.

Anyway, just thought I'd share my shopping habits with you. How about you? Are you a value and tease shopper like me?

"Sell Wal-Mart, Sell Caterpillar" - China Affects Every Stock You Own

So I got this email...one of those that you don't even remember when you signed up but continue to receive in your inbox that you normally just delete...yeah one of those emails. Well this one caught my attention. The subject: "Sell Walmart, Sell Caterpillar."

In the email, it goes on to say...

My name is Robert Hsu, and I have some shocking news for you: China affects every stock you own. Let me explain. Wal-Mart is a China stock. If Wal-Mart were an individual economy, it would rank ahead of Australia and Canada as China's 8th-biggest trading partner. But even this understates reality. A toy company like Hasbro is doing great business this holiday season, and over 20% of Hasbro's sales are through Wal-Mart. And most of Hasbro's toys are made in, you guessed it, China. Boeing, Motorola, Cisco, Autodesk, Yum Brands and Caterpillar--all are China stocks. They are China stocks either because their profits depend on China importing their goods (Boeing is both outsourcing the new 7E7 Dreamliner assembly AND counting on orders from China Air) or because their profits depend on imports FROM China. In fact, I would go even further. EVERY stock in your portfolio is a "CHINA STOCK." It is a China stock either because its fortunes are directly and openly enmeshed with China's astounding growth. Or it is a China stock because management has steadfastly IGNORED the fact that China is the newest, most DISRUPTIVE and most important factor in its survival. Which brings up a question that my American friends often find a little disturbing: What, exactly, is YOUR China investment strategy? Because, if I were to look inside your portfolio, the stocks you hold--yes and the bonds and even the real estate--would imply a very clear China Strategy.Then it goes on to say:

In this free special report you'll learn: * The surprising reason that McDonald's won't be successful in China. * What China's monstrous appetite for oil really means for ExxonMobil and Chevron. * Why you should buy Motorola but not Qualcomm. * The real reason so many U.S. stocks are riding high on the China Miracle and so many China stocks are failing. * Do you Baidu--and should you? * Are stocks listed on the Chinese exchanges poised to make a comeback in 2006? The answer may surprise you. * PLUS 7 U.S traded China stocks that you should avoid. Full details on all this and more in my new Report, "Red Flag Stocks." It's yours FREE when you go here now.If you're interested... http://investorplace.com/order/?pc=6GL152 I don't want to link it just because I don't feel comfortable having my readers head over to sign up...I'm not sure if they will try to "up sell" you. So I'm not going to link it, but you can copy and paste if you want. It's not a referral link...the "?pc=6GL152" part is just the specific document I believe. Anyway, I don't trust a lot of these things...If you couldn't tell already. Am I going to sign up? No...Interesting read though...

Tuesday, April 25, 2006

Mixed Feelings. My Payment Received.

Shucks!

Yes!

Yeshucks! My payment has been received by the IRS. My check cleared. Happy. Sad. It's left me feeling, well relieved but not. Oh well, I guess I should be happy I got a couple extra days of interests on my cash...oh wait! It's not in an interest bearing checkings. Ah, forget it. In case your payment hasn't cleared yet, and you're worried but not, check the status of it by calling (800) 829-1040. Read more about in my previous post. Just a word of caution, you will have to go through about 5 levels of phone menus before you reach someone. Tax payer money well spent :).

What To Do During a Recession? Depression?

I'm curious, would anyone be able to help me understand what my best options would be during a time of recession? How about a depression? Do you know what to do? I guess we wouldn't really know we're in a situation until after the fact...but still, it's good to know right?

Let me try to explain my understanding, a depression is a severe or long recession. I never knew this until I found it on Wikipedia, but apparently a recession can be due to inflation (value of money goes down, costs of goods go up) or deflation (value of money increases, costs of goods go down).

So during:

a) Inflationary recession, the value of cash is decreasing, thus the best investments would be non-cash investments, stocks?

b) Deflationary recession, the value of cash is increasing, so cash is king.

Would you agree with that? Since we're in a period of inflation right now, the biggest threat is too much inflation...thus we need to find the best investment vehicle that can beat inflation. Right? Am I completely confused? :/ Hopefully I didn't overly simplify everything...But just trying to understand the basics first...

My Dog Is Now Insured

Congrats Brownie! He's officially insured.

Only one exclusion on his acceptance, his skin infection problem.

Updated the Doggie costs.

Total cost to date: $3772.02

Doggie Pet Insurance

Monday, April 24, 2006

Is College a Worthless Investment?

I don't think so, but apparently it is something to consider. Everyone knows Bill Gates, founder of Microsoft just in case you didn't know, never finished college. Steve Jobs founder of Apple Computers never graduated from college. Larry Ellison of Oracle Corporation never finished college either! So what does this mean? Should we just skip an expense that can easily add up to at least $100k to work or pursue a trade? Maybe take some classes on the side? I don't know.

When I was deciding between colleges, not going to college was never an option. I ended up choosing my state university over an Ivy university. It saved me a ton of money, in fact I made some. I wrote about my decision earlier.

I would like to argue that Bill, Steve, and Larry are naturally gifted, just like pro athletes that have some natural born skill. With the combination of skill, drive, and some timing, they made things happen. The path they took to success is much different than most of the general population, so I would say they are exceptions. What about the rest of us?

This MSNBC.com article, Five Reasons To Skip College, says:

I don't think so, but apparently it is something to consider. Everyone knows Bill Gates, founder of Microsoft just in case you didn't know, never finished college. Steve Jobs founder of Apple Computers never graduated from college. Larry Ellison of Oracle Corporation never finished college either! So what does this mean? Should we just skip an expense that can easily add up to at least $100k to work or pursue a trade? Maybe take some classes on the side? I don't know.

When I was deciding between colleges, not going to college was never an option. I ended up choosing my state university over an Ivy university. It saved me a ton of money, in fact I made some. I wrote about my decision earlier.

I would like to argue that Bill, Steve, and Larry are naturally gifted, just like pro athletes that have some natural born skill. With the combination of skill, drive, and some timing, they made things happen. The path they took to success is much different than most of the general population, so I would say they are exceptions. What about the rest of us?

This MSNBC.com article, Five Reasons To Skip College, says:Reasons to skip college. Is higher education a good idea? 1. You'll be losing four working years 2. You won't necessarily earn less money 3. In fact, you could make more money 4. You can learn outside a classroom 5. Plenty of other people did fineI can't disagree more. Since much of life is about risk minimization, the fact that you have a college degree does in fact minimize the risk that you will not have work, and does maximize your potential to make more. I especially hate reason #5. But then again, if you have the drive and the ideas, why not skip college? I can't really argue against that either, but it's risky. What do you think? If you had a choice, would you go to school again? What about if your kids decided they didn't want to go to college? Let's say as the parent you believed they had what it takes to make it without the college degree. What if they were really good at sports, would you let them skip college?

Called the IRS. No Payment Received.

My IRS check hasn't cleared. Odd. My state one did already. So I called them, and they couldn't find my payment, but they did notate my account so that they know I sent payment. She said to wait until the end of this month, and then call back to check again.

Errr, why hasn't it cleared? Because I forgot to put my SSN on my check! I can't believe I didn't do that. The state cashed my check already though...and they didn't have my SSN. Come on IRS! Just because there are 250+ million people compared to my tiny state. You can match my address and name up, there are no excuses! Hah.

Anyway, in case you're having the same problem:

IRS FAQ document Keyword: Payment Voucher (1040-ES) 1.1 IRS Procedures: General Procedural Questions I'm concerned because my check payment to the IRS has not been cashed yet. What should I do? You can call (800) 829-1040 and ask an IRS representative if the payment has been credited to your account. If it has not and the check has not cleared your financial institution, you may choose to place a stop-payment on the original check and send another payment.

How Much Does Gas Cost In Other Countries?

Check out this article...pretty interesting read if you're the least bit curious...You can purchase gas for $0.12/gallon! Would be a far drive if you live in the US, but you could do it...I think...Can you?

Saturday, April 22, 2006

Signed Up For Doggie Pet Insurance

I should've got this when I first got Brownie, pet insurance. It's costing me $110.00/year for most injuries up to a maximum reimbursement of $9,000.00/year with a $50 deductible. Reimbursments vary by the type of injury. The main reason I'm getting this coverage is not so much because of the money, but the peace of mind that in case something horrible should happen to Brownie. I can make the decision to give him the best care regardless of the financial consequences. If I purchase a house next year, I may have some large expenses beyond what I'm expecting, I don't want to ever get into a situation where I have to decide between Brownie and something else

As you might have read, Brownie had been bitten a couple months ago, it costed me about $240.00 for the medical trip--he got stitches, sedation, eye exam, etc. Had I had the insurance, my out of pocket expense would have been the same, but I would've got $190.00 back. Of course the other owner did pay half, although I still think he should've paid the whole thing...that's another topic...and it's minor since Brownie is okay now.

Back to the insurance...They also offer a vaccination & routine care package for an additional $99.00/year, but I declined that because of the hassle. I definitely agree it would be worthwhile if you are diligent with all the paperwork and don't mind, but really the savings are not that large especially if you end up not getting some of the more minor "routine" care options. They also offer a "superior" pet plan which has the same rules as the standard plan, except coverage is increased to a max reimbursement of $14,000.00/year and the reimbursement amount per incident is increased as well. The cost increases to $210.00/year. I may switch him to the superior plan as he becomes an old fart. I'm going to update the doggie costs as soon as Brownie's been accepted.

Here are the details of coverage:

Superior Pet Plan

Standard Pet Plan

Vaccination & Routine Care option

Friday, April 21, 2006

Friday! Update: Home Tax Break, Smoking, and Panhandling 04.21.2006

I like to reflect on my own posts every so often, and I realize how lucky I am to be in the position I am. Wow, that sounded snooty...I don't mean it like that. Read on. At the same time, I realize that many bloggers post while trying to get out of debt, and then many bloggers are those that are doing really, really well. I try my best not to alienate anyone. We all, well most of us hopefully, have the same goal, that is to achieve financial freedom...how we get there is our own unique journey. Even this guy has the same idea...being able to stand on the street and smile is amazing and inspiring. Reading this post from Make Love, Not Debt inspired me too. Congratulations!

About my smoking, well, 48 days!!!! WOOHOO! $108.00 saved! I'll admit, I did have a smoke this past weekend, but it wasn't my pack...I know, one slip up, and it could lead me right back to where I was before.

I'm starting the process of purchasing a home, although I'm probably not going to become very serious until next year. I ran across a post that shed an interesting perspective on the tax advantages of home ownership. It's something I was curious about for some time...take a look, it's got good details. Which reminds, me congrats to SingleMa too and her home purchase!

Well, have an awesome weekend everyone!

Quit Complaining About Gas Prices!

I'm sick and tired of all the complaining about gas prices. Get over it! You choose to drive when there are public transportation options available. OMG!!!!

I'm just kidding. Seriously though, the pain of higher gas prices has opened many eyes here in America, mine included. The rest of the world might be laughing at us since they already pay so much more for gas. This graphic does a really good job of showing the gas cost breakdown...I thought you might be interested. http://www.washingtonpost.com/wp-dyn/content/graphic/2006/04/21/GR2006042100040.html

Looking at that graphic, you can see how companies like Exxon can make tons of money...since they touch everthing from collecting raw crude, to refining, to distribution, to the gas pump. Imagine taking a 20-30% profit at each step of the way...scary.

Supply and demand. New refining regulations and ethanol requirements. Crude oil reserves running low. Iran conflict. Venezuelan president. It all just points to the direction of increasing oil prices. I mean it's a limited resource...and given the laws of supply and demand, prices are just going to keep going up. We may have to just get used to it. There are reports that high gas prices are here to stay.

I guess the best plan is to really take a look at ourselves and how we can reduce gas usage. It's Just Money wrote about ways he's conserving gas. Even though I don't drive much, everyone around me is affected by higher gas prices. Gas and housing has got me worried about the economy.

http://www.washingtonpost.com/wp-dyn/content/graphic/2006/04/21/GR2006042100040.html

Looking at that graphic, you can see how companies like Exxon can make tons of money...since they touch everthing from collecting raw crude, to refining, to distribution, to the gas pump. Imagine taking a 20-30% profit at each step of the way...scary.

Supply and demand. New refining regulations and ethanol requirements. Crude oil reserves running low. Iran conflict. Venezuelan president. It all just points to the direction of increasing oil prices. I mean it's a limited resource...and given the laws of supply and demand, prices are just going to keep going up. We may have to just get used to it. There are reports that high gas prices are here to stay.

I guess the best plan is to really take a look at ourselves and how we can reduce gas usage. It's Just Money wrote about ways he's conserving gas. Even though I don't drive much, everyone around me is affected by higher gas prices. Gas and housing has got me worried about the economy.

http://www.washingtonpost.com/wp-dyn/content/graphic/2006/04/21/GR2006042100040.html

Looking at that graphic, you can see how companies like Exxon can make tons of money...since they touch everthing from collecting raw crude, to refining, to distribution, to the gas pump. Imagine taking a 20-30% profit at each step of the way...scary.

Supply and demand. New refining regulations and ethanol requirements. Crude oil reserves running low. Iran conflict. Venezuelan president. It all just points to the direction of increasing oil prices. I mean it's a limited resource...and given the laws of supply and demand, prices are just going to keep going up. We may have to just get used to it. There are reports that high gas prices are here to stay.

I guess the best plan is to really take a look at ourselves and how we can reduce gas usage. It's Just Money wrote about ways he's conserving gas. Even though I don't drive much, everyone around me is affected by higher gas prices. Gas and housing has got me worried about the economy.

http://www.washingtonpost.com/wp-dyn/content/graphic/2006/04/21/GR2006042100040.html

Looking at that graphic, you can see how companies like Exxon can make tons of money...since they touch everthing from collecting raw crude, to refining, to distribution, to the gas pump. Imagine taking a 20-30% profit at each step of the way...scary.

Supply and demand. New refining regulations and ethanol requirements. Crude oil reserves running low. Iran conflict. Venezuelan president. It all just points to the direction of increasing oil prices. I mean it's a limited resource...and given the laws of supply and demand, prices are just going to keep going up. We may have to just get used to it. There are reports that high gas prices are here to stay.

I guess the best plan is to really take a look at ourselves and how we can reduce gas usage. It's Just Money wrote about ways he's conserving gas. Even though I don't drive much, everyone around me is affected by higher gas prices. Gas and housing has got me worried about the economy.

How a 0% Balance Transfer Affected My Credit Score

I'm going to post my credit score because I think it's very beneficial since a lot of people have the question, "How will opening ________ 0% credit card affect my credit rating?" So I'll share my results with you.

My credit score: 762

The problem is that I don't know what my score was before opening the 0% credit card, so I don't know what effect it really had. Regardless, the effect could not have been that drastic.

In March of 06, I opened my Chase credit card and did a balance transfer. I've done 4 of these in the past, and so I was sort of concerned my credit score was being impacted, but not really...mainly because I didn't have any large expenses in the near future, like a house. Fast forward to today, I got my credit score, and was pleasantly surprised at the score. So apparently, whatever the effect opening credit cards may have, it doesn't always have a drastic effect on your score. But since I don't know the real process behind the credit score, effects may vary, so don't say I didn't warn you. It'd be interesting to hear if anyone else saw the same thing?

If you need more info on a 0% Balance Transfer, check out my previous post on it...

Thursday, April 20, 2006

Finding a Real Estate Agent is Just Like Getting Married

I went to a class yesterday called, "Role of the Realtor," and it was an eye opening experience. I never realized how much of an impact the agent can have, and you really are entering a "relationship" with this person. Really, it is almost like getting married isn't it? Well, in the best situations it is...you do, on many occassions, seem to form a lifelong bond...since your first house is often not the last.

From what I learned, I realized that trust is the single most important aspect in finding a realtor. Interview at least 3 of them to get acquainted and see if they understand your needs.

Personally here are the important factors in finding my realtor:

- Agent must be comfortable with disclosing number of clients currently serving, and possibly what types. I don't want an agent with lots of different clients looking for the same type of properties as I am.

- Agent must be willing to disclose financials of a transaction in full detail. I have no problem working with an agent to make them money, as long as I trust that they are also looking out for me. It's a two way street. If I have any sense that I'm being taken for, it just won't work.

- One that accepts my personality and is willing to deal with it. I have a tendency to be very picky and fickle on decisions. Unless I feel very comfortable with a decision, I can go very far in the process and decide to back out. Agent must understand that.

- Agent must have a few years of experience. Now, I don't want to automatically exclude new real estate agents, but I do want one that has a few years under his/her belt because it really does make a difference, especially in small communities because reputation and experience make for a much smoother transaction.

- One that can be honest and have my best interests at hand. If there's a good real estate deal on the floor, would the agent buy it instead of giving me an opportunity? Look at past deals...and ask around. One that comes with a recommendation is much better than shopping the classifieds.

- Do they mind 2 or 3 calls in a one hour period? Because sometimes I do that...

- Agent must be full time.

That's what I learned...Now if only I could really get married... :)

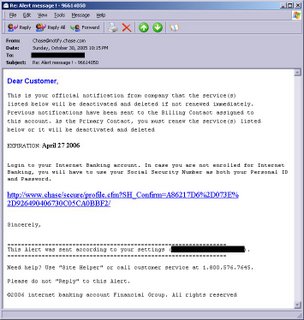

WARNING: Phishing Alert - Chase.com

Here we go again...another phishing email. This one is as sloppy as can be. It has no resemblence to an official Chase notice. I guess these phishing folks are getting lazy...they figure if you'll respond, you'll do it no matter what the email looks like.

X-Message-Status: n:0

X-SID-PRA: Chase@notify.chase.com

X-SID-Result: TempError

X-Message-Info: JGTYoYF78jET1GMF18uyNrF/V8fq9EIGrxJO5soVeSM=

Received: from LAN04 ([201.51.234.42]) by bay with Microsoft SMTPSVC(6.0.3790.1830);

Thu, 20 Apr 2006 09:14:44 -0700

Delivered-To:

Received: (qmail 3748 by uid 769); Mon, 31 Oct 2005 05:15:09 -0300

Date: Mon, 31 Oct 2005 05:15:09 -0300

Received: from LAN04 (201.51.234.42)

by LAN04 with SMTP;

Received: (qmail 3748 by uid 769); Mon, 31 Oct 2005 05:15:09 -0300

Message-Id: <20051031021509.3746.qmail@LAN04>

To:

Subject: Re: Alert message ! - 96614050

From:

Here we go again...another phishing email. This one is as sloppy as can be. It has no resemblence to an official Chase notice. I guess these phishing folks are getting lazy...they figure if you'll respond, you'll do it no matter what the email looks like.

X-Message-Status: n:0

X-SID-PRA: Chase@notify.chase.com

X-SID-Result: TempError

X-Message-Info: JGTYoYF78jET1GMF18uyNrF/V8fq9EIGrxJO5soVeSM=

Received: from LAN04 ([201.51.234.42]) by bay with Microsoft SMTPSVC(6.0.3790.1830);

Thu, 20 Apr 2006 09:14:44 -0700

Delivered-To:

Received: (qmail 3748 by uid 769); Mon, 31 Oct 2005 05:15:09 -0300

Date: Mon, 31 Oct 2005 05:15:09 -0300

Received: from LAN04 (201.51.234.42)

by LAN04 with SMTP;

Received: (qmail 3748 by uid 769); Mon, 31 Oct 2005 05:15:09 -0300

Message-Id: <20051031021509.3746.qmail@LAN04>

To:

Subject: Re: Alert message ! - 96614050

From: Business Idea? What's Your Thoughts On This One...

I'm all for free enterprise and creative business ideas, but this one is uhhh, interesting.

I wonder how they determine their fee...By pound? Size? Smell? Type? And looking deeper into this, what kind of owner would allow large amounts of poo to collect until someone comes to pick it up...I guess if you have a large yard, it might be okay, but still...

Anyway, I just thought it was funny...I can't imagine starting a business like this...I already have some hesitation picking my own dog's poop!

I'm all for free enterprise and creative business ideas, but this one is uhhh, interesting.

I wonder how they determine their fee...By pound? Size? Smell? Type? And looking deeper into this, what kind of owner would allow large amounts of poo to collect until someone comes to pick it up...I guess if you have a large yard, it might be okay, but still...

Anyway, I just thought it was funny...I can't imagine starting a business like this...I already have some hesitation picking my own dog's poop!

Wednesday, April 19, 2006

Maxing Out Your 401K and IRA, Rational?

My friend always brings up this topic, and debating it with him is like trying to debate which came first, the chicken or the egg. In my opinion, if you don't need the money now, put it away whatever you can afford to for retirement. Makes sense right? But my friend believes that, sure you should put away for retirement, but just the minimum to get matching, why? Because he doesn't believe it's wise to lock up all that money for something you don't even know you'll be around for. He does have a point. What if all this money we're saving for retirement just doesn't come around? I know, how depressing is that...but what if? It's important to consider it.

So, there is a balance point, and it seems like that point is very unique to each individual. I myself try to put away whatever I can up to the federal limit...might as well. What do you do? Do you max out your retirement contribution?

Tuesday, April 18, 2006

My Desk, My Very Messy Desk

*WARNING* The desk you are about to see contains lots of paper, clutter, and stuff I haven't touched for years. If you are a neat freak, it is advised that you hit the back button on your browser now!

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Okay, here we go...because of PF Advice's post on her desk vs Bill Gates' desk...I just had to take a look at my "desk."

From left to right...

- Here you see notebook 1. Where my pfblogging is done.

- My posterboard (aka wall)

- Keyboard for desktop computer

- Here you see notebook 1. Where my pfblogging is done.

- My posterboard (aka wall)

- Keyboard for desktop computer

- My work comp!

- Old school MS Keyboard

- Dell 2005FPW - Awesome!

- Puppy Kong Stuff

- Aspirin (for bad days at work)

- Pile o Paper (very important)

- Can of Arizona Green Tea with Ginseng and Honey (awesome!)

- My work comp!

- Old school MS Keyboard

- Dell 2005FPW - Awesome!

- Puppy Kong Stuff

- Aspirin (for bad days at work)

- Pile o Paper (very important)

- Can of Arizona Green Tea with Ginseng and Honey (awesome!)

- Uhhh, yeah, how about I skip this part...

Yes, I work from home.

- Uhhh, yeah, how about I skip this part...

Yes, I work from home.

And of course... Brownie, aka feet warmer, under the desk. Yes, my desk compares horribly to Mr. Gates' desk, but he doesn't have a feet warmer. :)

And of course... Brownie, aka feet warmer, under the desk. Yes, my desk compares horribly to Mr. Gates' desk, but he doesn't have a feet warmer. :)

- Here you see notebook 1. Where my pfblogging is done.

- My posterboard (aka wall)

- Keyboard for desktop computer

- Here you see notebook 1. Where my pfblogging is done.

- My posterboard (aka wall)

- Keyboard for desktop computer

- My work comp!

- Old school MS Keyboard

- Dell 2005FPW - Awesome!

- Puppy Kong Stuff

- Aspirin (for bad days at work)

- Pile o Paper (very important)

- Can of Arizona Green Tea with Ginseng and Honey (awesome!)

- My work comp!

- Old school MS Keyboard

- Dell 2005FPW - Awesome!

- Puppy Kong Stuff

- Aspirin (for bad days at work)

- Pile o Paper (very important)

- Can of Arizona Green Tea with Ginseng and Honey (awesome!)

- Uhhh, yeah, how about I skip this part...

Yes, I work from home.

- Uhhh, yeah, how about I skip this part...

Yes, I work from home.

And of course... Brownie, aka feet warmer, under the desk. Yes, my desk compares horribly to Mr. Gates' desk, but he doesn't have a feet warmer. :)

And of course... Brownie, aka feet warmer, under the desk. Yes, my desk compares horribly to Mr. Gates' desk, but he doesn't have a feet warmer. :)

Where Have I Been?

I'm not so sure myself actually. Just kidding, I've been quite busy with work recently, so I haven't had as much time to blog. I even missed the Friday! Update...however, I did have a couple posts I've been meaning to publish...So I'll try to do one soon...

Monday, April 17, 2006

Money Going To The Dog$

Pet ownership is a topic that hits close to home for me...My dog is just past 7 months old, and when you look at the overall costs, he's expensive! But that's okay, he's my dog and my pride and joy.

Well, I came across an interesting article at MSNBC.com on the pet boarding industry. I have Brownie signed up for doggie day care, basically on days when it's raining, when I don't have time to take him on his walk, or just when he hasn't been around other dogs for a long period, I'll drop him off there.

Lots of interesting stuff in the article like:

Annual spending on dogs: $1,588.00

Annual spending on cats: $948.00

Now to find a way for Brownie to earn some money...

Asset Reallocation, Version 3.0: And the Winner Of $50K Is...

I'm planning on shifting approximately $50k from cash accounts to stocks. Specific stocks include Johnson & Johnson, Procter & Gamble, Dupont, IBM, Wal-Mart, VZ, 3M, Raytheon, GE. I haven't decided yet, so there is no "winner" at this moment...but soon.

I would really like to consider some alternative energy stocks as well...anyone have some input on any stocks I should consider? I don't know where to start...so many alternative energy stocks to choose from.

My primary requirements for stock consideration:

- Near 52wk low?

- Chart indicates flat performance or down pattern?

- Dividend?

- Comparison to competitors in same industry?

- Company outlook?

- Management?

- Aggressive compared to competitors in industry?

My personal 2007 financial considerations:

1. I may want to buy a house, I would like to have ~100k available for a downpayment. Serious shopping to start around June 2007.

2. I have some CDs set to mature, latest one in June 2007.

3. These are not retirement stock investments. My retirement stocks are invested in company provided funds.

Johnson & Johnson (JNJ)

Current: 57.91, 52wk low: 56.70

Dividend: ~2.3%

I like this stock. A great brand, more baby boomers retiring, long term, I think this stock is a great buy.

Procter & Gamble (PG)

Current: 56.60, 52wk low: 51.91

Dividend: ~2.2%

Both JNJ and PG look good.

Du Pont (DD)

Current: 43.30, 52wk low: 37.60

Dividend: ~3.4%

3M (MMM)

Current: 80.97, 52wk low: 69.71

Dividend: ~2.3%

I don't really like 3M compared to DD and JNJ.

General Electric (GE)

Current: 33.89, 52wk low: 32.21

Dividend: ~3.0%

Compared to C, PHG, and SI, GE's stock performance looks flat.

Wal-Mart (WMT)

Current: 45.77, 52wk low: 42.31

Dividend: ~1.5%

I like Wal-Mart compared to COST and TGT, they are trading lower and have a better outlook. Of course they are huge, may be too big in fact...

Verizon (VZ)

Current: 32.81, 52wk low: 29.13

Dividend: ~4.9%

Overall the telecom industry is questionable...with VoIP, wireless, I'm wondering where telecom will go. Plain old telephone lines will be here for a while though...Great dividend.

Aggressive advertising.

Raytheon (RTN)

Current: 43.69, 52wk low: 35.96

Dividend: ~2.2%

Not really the best time to get into this stock, but I like the outlook for the military industry.

International Business Machines (IBM)

Current: 81.93, 52wk low: 71.85

Dividend: 1.0%

Not real attractive although they have been flat for sometime now...I'm not so confident in the tech industry...Dividend payout is fairly low.

Previous posts:

Major Asset Allocation, But Where? Part 2

Asset Reallocation, Version 1.0

Major Asset Allocation, But Where? Part 1

I also found a post by Dividend Guy that had info on using the Yahoo! Stock Screener...sounds pretty cool, I may check it out later...May 1st is quickly approaching! I gotta get my funds ready. Any feedback, ideas?

Sunday, April 16, 2006

Hey IRS, You Do My Taxes!

So this morning, as I was reading my local Sunday newspaper, I found an interesting article titled "Would you want IRS doing your taxes?" I thought to myself, "Heck yeah! Wouldn't that be awesome?"

I wrote a series on a National Sales Tax becoming the preferred tax system over the current US income tax system. One of the main reasons I would like to see something like that is because of the amount of time and, in my opinion, wasted resources going into figuring out how much you owe.

The article was written by Robert Guy Matthews of the Wall Street Journal. In it he writes:

Imagine that filing your tax return was as simple as receiving a completed form from the Internal Revenue Service, signing it, then waiting for a refund of writing a check.I definitely could! The proposed "Automatic 1040" system takes into consideration that the government already has 1) Your W-2 Forms, 2) 1099 Forms, 3) 1098 Forms, and 4) Your previous tax returns. Of course more complex taxes would require more data. California actually ran a pilot project called "Ready Return," which did states taxes for 11,500 people. Seems pretty cool. Guess who's against this proposal? Not suprisingly, the tax preparation industry. :) President Bush is also against this proposal because of the costs involved, but heck I'd be happy if a portion of what I'm already paying the government went to paying for this service. Of course, I don't want the government to raise taxes...I'm sure they can find some cash out of the $29 billion set aside for special projects by our government. Unfortunately, I couldn't find an online copy of the article. Sorry, but if you have a WSJ id, maybe you can find it. Anyway, with the 2005 tax season behind us, well the majority of us, I guess we can take solice in knowing it's over until next April. Well, Happy Easter Sunday! Hope this week turns out awesome!

Saturday, April 15, 2006

Friday, April 14, 2006

Asset Reallocation, Version 2.0

So I been thinking about my asset reallocation, continuing on what I wrote earlier, I realize I have the following criteria:

- Large - mid cap stocks.

- Aggressive marketting strategy.

- Dividend paying.

- Near to their 52 week lows, the better.

- Relatively flat over the past year.

- Positive industries: Healthcare, Energy (especially renewable), Military, Retail (low cost, food, groceries), Basic Consumables (personal care, paper)

- Almost positive industries: Airline, Technology, Telecom/Communications

- Negative industries: Financial, "Luxury" "High End" Markets, Housing, Insurance, Automotive

I saw this post from Investment Ideas that had a good graphic of dividend paying quality stocks. Another article from MSN Money written in Nov 05, still holds true for stocks described.

When considering all thought factors, some bigger names that came to mind were:

Johnson & Johnson, Procter & Gamble, Dupont, IBM, Wal-Mart, VZ, AT&T.

If I had to choose my investments right now, I'd go with JNJ, DD, WMT, and VZ, spread evenly 25%. Agh, more research to do.

I would consider mutual funds, but I've just had bad experiences with them, and to be honest, I'm not sure if I trust them anymore. I should get over it, but it might take awhile. Well, until version 3.0...

Sorry no Friday! Update today. I'm short on blogging time, but have a great weekend everyone!

Thursday, April 13, 2006

When To Use Reward / Mileage Points

Saving money, understandable. Saving reward points and miles, not. I mean you can earn interest on saving money or investing, but what does holding on to points give to the holder? Nada. Zip. Nothing. So when to use it? How do you maximize the value of each mile or point?

Well, with points it's easy to figure out...that is if you use it to redeem gift certificates. Since redeeming points for electronics and other items have varying values, it's more difficult to figure out when you get the most for your points. I typically stay away from non-gift card rewards. I only have experience with Chase's Flexible Rewards and Citi's ThankYou Network.

Typically, if you can find a reward where 1 point = 1 cent, then it's a good deal. For example, at the ThankYou Network, you can get a $50 BestBuy gift card for 5,000 points. If you look at a $100 BestBuy gc, it's 10,000 points, so there is no advantage waiting. However, if you get a $25 BestBuy gc, you have to redeem 3,000 points. Not good.

With miles, it get a little trickier. You have to take a look at your individual location, your planned destination, your airlines travel rewards, and time of the year, since off-peak and peak seasons can have different mile requirements. The best time to use your miles would generally be when you are traveling the furthest distance between your origin and your destination. For example, if you are California, you can fly to Europe during off-peak for 40,000 miles. Not a bad deal! Now if you are on the east coast, you can fly to Hawaii for 35,000, which is a much better deal than flying to Europe for 40,000 miles. For folks in Hawaii, 40,000 miles will get you a trip to Europe! Pretty awesome deal.

Where I run into problems is the fact that I don't use these miles right away, and they end up sitting in my account, accumulating. If it sits there for a few years, then you really start losing value! Why? Because even though you're not getting the most for your miles, they are sitting there doing absolutely nothing. So, the best time to redeem is highly dependent on the situation.

That's it for now...

Wednesday, April 12, 2006

Save Money By Changing Something Very Simple...I Promise.

I never knew there were so many ways to tie shoelaces! Here's a direct link to my recommended shoelace tying method.

So you're wondering, why is this not an "Off Topic" post? Well, if you use the recommended method of tying your shoelaces, the laces will last longer and it'll take you less time to tie your shoelaces, and we all know time = money! Now that is FRUGAL! And I learned something new to boot! I'm kind of excited to put on a pair of shoes now...whowouldathunkit.

I never knew there were so many ways to tie shoelaces! Here's a direct link to my recommended shoelace tying method.

So you're wondering, why is this not an "Off Topic" post? Well, if you use the recommended method of tying your shoelaces, the laces will last longer and it'll take you less time to tie your shoelaces, and we all know time = money! Now that is FRUGAL! And I learned something new to boot! I'm kind of excited to put on a pair of shoes now...whowouldathunkit.

2005 Tax Payments In the Mail. :(

There goes $2,300.00! Bye bye. Sayoonara. Adios. Aloha.

Mailed off my remaining taxes that were due for 2005 yesterday. It kind of sucks, and I got to start thinking about ways to reduce my taxes next year. What to do, what to do. 17% could be improved upon...

Don't forget to mail yours if you haven't already...I believe the latest it can be postmarked is Monday, April 17th, since April 15th is a Saturday. But double check! I wouldn't want you to get penalized because of my post.

Financial Web Site Security. The Best Defense Is In the Details.

Larger corporations have been making strides in providing secure access beyond the primitive username password combination. At the same time, smaller financial institutions have not. At least that seems to be the case with financial institutions I use. Although, I will admit my credit card companies seem to be falling behind in that area as well. Bank of America seems to be the only one that has taken a few extra steps to protect me. I haven't seen anything from Chase, Citi, American Express, and MBNA yet. Well, I thought it'd be interesting to take a look at a few of the systems in place.

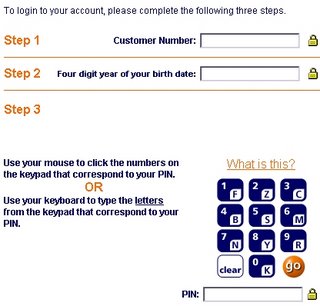

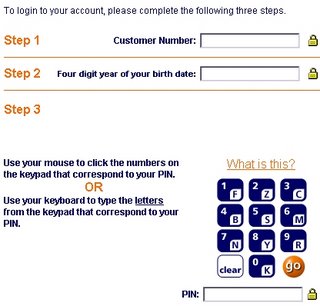

ING (Security Page):

Three field security, using a customer number, PIN, and a personal question.

In my opinion this is the best security system. It's a good combination of convenience and security. I do with they would increase the question pool though.

HSBCDirect (Security Page):

Three field security, using a customer number, PIN, and a personal question.

In my opinion this is the best security system. It's a good combination of convenience and security. I do with they would increase the question pool though.

HSBCDirect (Security Page):

HSBC uses a 2 tier system, and combination of the username/password, but then a second password for bank to bank transfers that can only be entered using your mouse.

Convenient? NO. Secure? Not bad. I like this system, but it's not really that secure. In essence the safe is locked tight, but the entrance to the bank is left wide open. Also, the buttons could be a little larger.

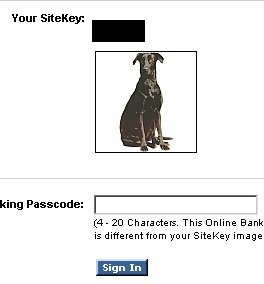

Bank of America (Security Page):

HSBC uses a 2 tier system, and combination of the username/password, but then a second password for bank to bank transfers that can only be entered using your mouse.

Convenient? NO. Secure? Not bad. I like this system, but it's not really that secure. In essence the safe is locked tight, but the entrance to the bank is left wide open. Also, the buttons could be a little larger.

Bank of America (Security Page):

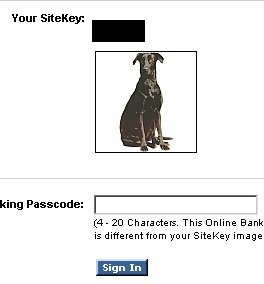

BofA uses a typical username/password combination with a twist known as a "Sitekey." You enter your username, and then you are presented with a Sitekey. The Sitekey is an image that will be displayed if you are looking at the authentic BofA website. This image is one you choose. If you don't see your sitekey, then that means you shouldn't be entering your password.

I like the concept. However, I don't like the implementation. It's a little too clunky, and I think it's acceptance is going to be harder because of it.

Summary:

Overall, I believe if they combined BofA's Sitekey security with ING's personal question system with multiple questions (the larger the pool, the better), the system would be highly secure. A system like BofA's will help confirm to the user that you are at the right place, then the personal question will confirm your identity. The 2 tier system is an improvement from the username/password security system, but criminals could have access to your preliminary information, which is not good, so I would not support this system as the de facto standard.

The worst security scheme I can think of? Login with your account number and a simple password. WRITE YOUR BANK NOW! Seriously, tell them to fix it or take your banking somewhere else.

Action to take:

It's always a good idea to be aware of the sites you are entering your personal information! Just take an extra second to glance at the bottom right corner for the little lockpad and the proper URL in the address box. These two steps alone can help prevent giving away valuable information.

Also, don't enter personal information at public workstations, no matter how much you need to do so. Anyone and everyone can use the system, and you don't know what sort of spy apps are running in the background. The security hack could even be as primitive as someone standing over your shoulder!

Finally, if your financial instituion does not have anything but the username/password security system, WRITE them and let them know you want something more secure. It's way too easy to break in. Do you have any other interesting security measures you've seen? Of course there are biometrics, but I'm not a big fan of that either. I like security systems that depend on information stored in my brain, it seems like the most secure location to keep security info. :)

BofA uses a typical username/password combination with a twist known as a "Sitekey." You enter your username, and then you are presented with a Sitekey. The Sitekey is an image that will be displayed if you are looking at the authentic BofA website. This image is one you choose. If you don't see your sitekey, then that means you shouldn't be entering your password.

I like the concept. However, I don't like the implementation. It's a little too clunky, and I think it's acceptance is going to be harder because of it.

Summary:

Overall, I believe if they combined BofA's Sitekey security with ING's personal question system with multiple questions (the larger the pool, the better), the system would be highly secure. A system like BofA's will help confirm to the user that you are at the right place, then the personal question will confirm your identity. The 2 tier system is an improvement from the username/password security system, but criminals could have access to your preliminary information, which is not good, so I would not support this system as the de facto standard.

The worst security scheme I can think of? Login with your account number and a simple password. WRITE YOUR BANK NOW! Seriously, tell them to fix it or take your banking somewhere else.

Action to take:

It's always a good idea to be aware of the sites you are entering your personal information! Just take an extra second to glance at the bottom right corner for the little lockpad and the proper URL in the address box. These two steps alone can help prevent giving away valuable information.

Also, don't enter personal information at public workstations, no matter how much you need to do so. Anyone and everyone can use the system, and you don't know what sort of spy apps are running in the background. The security hack could even be as primitive as someone standing over your shoulder!

Finally, if your financial instituion does not have anything but the username/password security system, WRITE them and let them know you want something more secure. It's way too easy to break in. Do you have any other interesting security measures you've seen? Of course there are biometrics, but I'm not a big fan of that either. I like security systems that depend on information stored in my brain, it seems like the most secure location to keep security info. :)

Three field security, using a customer number, PIN, and a personal question.

In my opinion this is the best security system. It's a good combination of convenience and security. I do with they would increase the question pool though.

HSBCDirect (Security Page):

Three field security, using a customer number, PIN, and a personal question.

In my opinion this is the best security system. It's a good combination of convenience and security. I do with they would increase the question pool though.

HSBCDirect (Security Page):

HSBC uses a 2 tier system, and combination of the username/password, but then a second password for bank to bank transfers that can only be entered using your mouse.

Convenient? NO. Secure? Not bad. I like this system, but it's not really that secure. In essence the safe is locked tight, but the entrance to the bank is left wide open. Also, the buttons could be a little larger.

Bank of America (Security Page):

HSBC uses a 2 tier system, and combination of the username/password, but then a second password for bank to bank transfers that can only be entered using your mouse.

Convenient? NO. Secure? Not bad. I like this system, but it's not really that secure. In essence the safe is locked tight, but the entrance to the bank is left wide open. Also, the buttons could be a little larger.

Bank of America (Security Page):

BofA uses a typical username/password combination with a twist known as a "Sitekey." You enter your username, and then you are presented with a Sitekey. The Sitekey is an image that will be displayed if you are looking at the authentic BofA website. This image is one you choose. If you don't see your sitekey, then that means you shouldn't be entering your password.

I like the concept. However, I don't like the implementation. It's a little too clunky, and I think it's acceptance is going to be harder because of it.

Summary:

Overall, I believe if they combined BofA's Sitekey security with ING's personal question system with multiple questions (the larger the pool, the better), the system would be highly secure. A system like BofA's will help confirm to the user that you are at the right place, then the personal question will confirm your identity. The 2 tier system is an improvement from the username/password security system, but criminals could have access to your preliminary information, which is not good, so I would not support this system as the de facto standard.

The worst security scheme I can think of? Login with your account number and a simple password. WRITE YOUR BANK NOW! Seriously, tell them to fix it or take your banking somewhere else.

Action to take:

It's always a good idea to be aware of the sites you are entering your personal information! Just take an extra second to glance at the bottom right corner for the little lockpad and the proper URL in the address box. These two steps alone can help prevent giving away valuable information.

Also, don't enter personal information at public workstations, no matter how much you need to do so. Anyone and everyone can use the system, and you don't know what sort of spy apps are running in the background. The security hack could even be as primitive as someone standing over your shoulder!

Finally, if your financial instituion does not have anything but the username/password security system, WRITE them and let them know you want something more secure. It's way too easy to break in. Do you have any other interesting security measures you've seen? Of course there are biometrics, but I'm not a big fan of that either. I like security systems that depend on information stored in my brain, it seems like the most secure location to keep security info. :)

BofA uses a typical username/password combination with a twist known as a "Sitekey." You enter your username, and then you are presented with a Sitekey. The Sitekey is an image that will be displayed if you are looking at the authentic BofA website. This image is one you choose. If you don't see your sitekey, then that means you shouldn't be entering your password.

I like the concept. However, I don't like the implementation. It's a little too clunky, and I think it's acceptance is going to be harder because of it.

Summary:

Overall, I believe if they combined BofA's Sitekey security with ING's personal question system with multiple questions (the larger the pool, the better), the system would be highly secure. A system like BofA's will help confirm to the user that you are at the right place, then the personal question will confirm your identity. The 2 tier system is an improvement from the username/password security system, but criminals could have access to your preliminary information, which is not good, so I would not support this system as the de facto standard.

The worst security scheme I can think of? Login with your account number and a simple password. WRITE YOUR BANK NOW! Seriously, tell them to fix it or take your banking somewhere else.

Action to take:

It's always a good idea to be aware of the sites you are entering your personal information! Just take an extra second to glance at the bottom right corner for the little lockpad and the proper URL in the address box. These two steps alone can help prevent giving away valuable information.

Also, don't enter personal information at public workstations, no matter how much you need to do so. Anyone and everyone can use the system, and you don't know what sort of spy apps are running in the background. The security hack could even be as primitive as someone standing over your shoulder!

Finally, if your financial instituion does not have anything but the username/password security system, WRITE them and let them know you want something more secure. It's way too easy to break in. Do you have any other interesting security measures you've seen? Of course there are biometrics, but I'm not a big fan of that either. I like security systems that depend on information stored in my brain, it seems like the most secure location to keep security info. :)

Tuesday, April 11, 2006

Off Topic: Grammar, Does It Matter To You?

Okay, I'll admit, I'm a very bad blogger. Well okay, not a bad blogger, but a bad writer. Well okay, not a bad writer, a lazy one. I'm bad a double checking my post for grammatical and spelling errors. See, I already made a mistake. I'm sorry. Even the Blarney can't help me! :(

It does bother me when I re-read my own post and find errors, which I do on occassion. But in most cases, I just like getting the idea out of my head and stopping. My thoughts are often discombobulated, and well, just all over the place--funny because the way I write is really the way I am too. Organization is not my forte...I may suffer from some mental disorder yet to be diagnosed. I love elipses and inappropriate punctuations abound? Seriously, everytime I write something and then I re-read, I find at least a few letters or even whole words missing, and I think to myself, "What the heck?!" Like if I meant to write:

"In order to portray professionalism to your readers, it is highly recommended that you double check grammar and spelling in your compositions."

It will often look like this:

"In order to protray professionalism to you're readers it is highly recommended that double check grammar and spelling in your composition."

Yuck!

So by admitting this, am I committing blogger suicide? How much does grammar affect your readership? Most blogs that I read, are very well written. I'm quite jealous. Do I want to change my blogging style? I guess in a way I do, but at the same time I don't. Hah. Hey it's my blog, and I write however I want! :P What do you think? Warning, I did not re-read this post.

I'm Still Curious. Tax Audits, Ever a Refund?

I know I wrote about this once, but no one commented...Just trying again. With IRS audits, do they ever audit and find you overpaid? I would think it could...but has it ever really happened? Anyone?

Monday, April 10, 2006

WARNING: Phishing Alert - Paypal.com

FAKE LINK: Click here to receive access to confirmation page redirects to

http://kgp21h.info/https/www.paypal.com/webscr/login.htm.

Bored? Give them some fake info!

X-Message-Status: s3:0

X-SID-PRA: support@paypal.com

X-SID-Result: SoftFail

X-Message-Info: 6sSXyD95QpUd24OyXs1fLakDN1QDAzoZvMxAkySqdIM=

Received: from OEM-MICRO ([203.90.192.144]) by bay0-mc4-f14.bay0.hotmail.com with Microsoft SMTPSVC(6.0.3790.1830);

Mon, 10 Apr 2006 11:39:49 -0700

Delivered-To:

FAKE LINK: Click here to receive access to confirmation page redirects to

http://kgp21h.info/https/www.paypal.com/webscr/login.htm.

Bored? Give them some fake info!

X-Message-Status: s3:0

X-SID-PRA: support@paypal.com

X-SID-Result: SoftFail

X-Message-Info: 6sSXyD95QpUd24OyXs1fLakDN1QDAzoZvMxAkySqdIM=

Received: from OEM-MICRO ([203.90.192.144]) by bay0-mc4-f14.bay0.hotmail.com with Microsoft SMTPSVC(6.0.3790.1830);

Mon, 10 Apr 2006 11:39:49 -0700

Delivered-To: One More Financial Touchdown

Just over a week ago, I wrote My Top 5 Financial Touchdowns. Well, as I thought about it more I realized, I missed one! Shifting my 401k allocation to Treasury Inflation Protected Securities (TIPS) fund in 2002 (I think, I tried to look up the specific records, but apparently my 401k site only hold detailed data going back to 2003). When I think back on it, it was very uncharacteristic of me, and actually a little stupid, but it paid off.

I was down approximately $4,000 in my 401k. Considering I only had about $20,000, this was a pretty big chunk. Part of the reason was I was invested heavily in my company stock, not a good move. Well, I look at the performance of various funds available to me in my 401k, and TIPS were available. I transferred 100% to it, and it paid off. The TIPS fund rose over the year, by around 20% I believe, making back what I had lost, even gaining a bit by the end of the year.

Sorry I don't have the specific numbers, but the lesson I learned is that sometimes you just get lucky. Really I did just get lucky. It was the perfect time...Of course had I switched earlier, I would've made even more. Then again, my current investment in TIPS has led around a 2% decline this year to date. So...As I'm getting older, I'm learning risk minimization is important, and having my entire 401k locked up in one single fund is not a good idea...in most situations. Now to diversify...

Buying a House Is Pretty Complicated If...

...you're not prepared. I just took a class, and thought I'd share some of the things I learned...It was a really intro class, so I apologize if some of what I have to say is a little pre-K-ish.

- Find your own class! Especially if you're new to the whole process. My credit union offered free classes.

- Did you know FICO stood for Fair Isaac's Co.? The company that created the equation.

The breakdown:

35% Payment History

15% Length of Credit History

30% Amounts Owed

10% New Credit

10% Types of Credit Used

I wish I knew more about this magical forumla! I later found breakdown information is posted at myfico.com. Although they still don't tell you the magic formula.

- Why do they keep the FICO equation secret? Actually, how did they keep it secret for so long. How are people to improve their scores if they really don't know how it's calculated.

- The speaker didn't give an indication as to when they would start looking at the new Vantage scores.

I've never purchased a house...but the general process doesn't seem all that bad if you're prepared. On the other hand, if you're not prepared, wow. I never knew where to start, but after taking the class, I at least have an idea now...Well, here's the basic process...I'm sure it could be a lot more complicated:

1. Pre-Qualify!

2. Find a Realtor.

3. Think about insurance coverage.

4. Morgage Broker (can shop around for you)

5. Find a house.

5a. Home inspection.

6. Make offer.

7. Counter offer if applicable.

8. Enter "contract period".

9. Contact loan officer to apply and get formal letter with amount of loan.

10. Get "Good Faith" loan.

11. Lock in interest rate. You can actually lock in advance, you just need to know amount of loan. The longer the period you lock a rate, the higher interest you pay...15, 30, 45, and 60 day locks are typical. If rates go down, it is possible to adjust, but it is not very easy. Rates are almost like gambling really.

12. Appraisal is requested to confirm value of house.

13. Escrow established to handle the cash flow between buyer, seller, and various agencies that fees are due.

14. Proof of insurance required.

15. Signing of all paperwork scheduled at escrow.

16. Funding of mortgage happens.

17. Recording of the new mortgage loan, thus you become a homeowner!

18. Maintain. :)

Sunday, April 09, 2006

Ummm, $218,000,000,000,000.00 Phone Bill

Yeah, you read it right...a man is hit with a $218 trillion dollar phone bill! Remind me not to sign up with Telekom Malaysia. :) Wow.

Friday, April 07, 2006

Off Topic: Suddenly a Single Dad

If you haven't read this story of the bald eagle, it's a bit of a tear jerker...Apparently his female partner got hurt pretty bad protecting their nest...I hope Martha gets better!

What's My Dream Life?

City Girl had a post up about what her dream life would be...and it got me thinking...what would my dream life be? Makes sense that you need to have an idea of what you want to achieve, and the idea has to be composed of more than just some big fancy number...like $2.5 million.

So what would my dream life be? Well, for starters I'd want a modest house that's well kept and not in major need of repair. If it had a nice view of the mountains or the ocean, that'd be great, but not a necessity. A good neighborhood and neighbors are way more important to me. I'd want a fairly large, grassy, fenced yard, maybe 5000-10000 square feet, with no dangerous plants so my dog can romp around without a care...It'd help if there were no holes or spots where he could crawl into and get all dirty as well. Speaking of my dog, I'd want to get him a companion to play with, maybe a beagle or possibly another lab. Then I'd want a nice garage, could be an open one, as long as it keeps the rain out, and has enough room for two cars, my daily driver and my weekend car. What should I get as my "weekend car"?? Things would change with a family...maybe a 3 car garage then :). I'd also want my house to be completely CAT-5 wired, of course wireless would be available as well, but the CAT-5 would allow me to have gigabit ethernet :D. Broadband Internet is nice, but I'd like to have some type of Internet2 connection or at least a service like FIOS...super fast Internet. I'd have to have a few big DLP projection TVs...That's kind of odd now that I look at it, a modest house, but tons of fancy gadgets inside...yeah, that sounds just right! I don't want it to be all flashy from the outside.

Hmmm, what else? Oh yeah the finances...How can I forget that? I'd like to have enough money to eat out every night and buy electronics without real concern for my net worth. Actually, I'd always have a concern for that, which is why I don't know if I could ever really spend what I'd want to spend...at least at one time anyway. Optimally, if I could live off of dividends and interest, that would be where I'd like to be. I'd say a yearly net income from investments of $150,000k, with $50k going back to grow my net worth, while the $100,000k would be for me. How can I forget??? And no debt!

I'd also like to be able to donate time and money to my high school and the humane society. I'd like to be able to work on my computers, take some classes on computers, work on some fun web stuff, maybe have a side business that doesn't entail too much labor (am I lazy or what?!?!), and I'd like to learn how to play the guitar. I have no musical talent so this would probably take up a large chunk of my time. Finally, I'd want to be able to sleep in until whenever I wanted everyday...then get up and not have a to worry or think about anything I don't want to that day...like computer problems or deadlines!

Now if, I could buy a house for my family and friends, and support them financially, that would really make my dream, but I want to be somewhat realistic in dreaming too...lol. So there it is...And I think $2.5mil would be able to cover all that...how about you? What's your dream life? PS I might be revising this every so often. It seems like I keep thinking of other things for my dream when I hit the "Publish Post" button. :)

WARNING: Phishing Alert - Chase.com

I'm going to post these phishing scams when I receive them just to keep records. If it helps someone avoid getting scammed, then all the better! I really hate these scams. If you're bored, click on the link below and give them some FAKE info...

PHISHING LINK: https://Chase.com/update.php?account0429055

X-Message-Status: n:0

X-SID-PRA: Chase@update15.Chase.com

X-SID-Result: TempError

X-Message-Info: JGTYoYF78jGERDolRkZXK3aSevcWKGnNUwnJLp5ZCIU=

Received: from gt ([125.133.1.75]) by bay0-mc9-f3.bay0.hotmail.com with Microsoft SMTPSVC(6.0.3790.1830);

Fri, 7 Apr 2006 05:47:07 -0700

Delivered-To:

I really hate these scams. If you're bored, click on the link below and give them some FAKE info...

PHISHING LINK: https://Chase.com/update.php?account0429055

X-Message-Status: n:0

X-SID-PRA: Chase@update15.Chase.com

X-SID-Result: TempError

X-Message-Info: JGTYoYF78jGERDolRkZXK3aSevcWKGnNUwnJLp5ZCIU=

Received: from gt ([125.133.1.75]) by bay0-mc9-f3.bay0.hotmail.com with Microsoft SMTPSVC(6.0.3790.1830);

Fri, 7 Apr 2006 05:47:07 -0700

Delivered-To:

Received: (qmail 2478 by uid 264); Fri, 7 Apr 2006 09:46:59 +0900

Date: Fri, 7 Apr 2006 09:46:59 +0900

Received: from gt (125.133.1.75)

by gt with SMTP;

Received: (qmail 2478 by uid 264); Fri, 7 Apr 2006 09:46:59 +0900

Message-Id: <20060407184659.2476.qmail@gt>

Subject: Security account update 2401139.

From:

MIME-Version: 1.0

Content-Type: text/html; charset="iso-8859-1"

Content-Transfer-Encoding: 8bit

Return-Path: dreid48@hotmail.com

X-OriginalArrivalTime: 07 Apr 2006 12:47:07.0400 (UTC) FILETIME=[61092080:01C65A41]

I really hate these scams. If you're bored, click on the link below and give them some FAKE info...

PHISHING LINK: https://Chase.com/update.php?account0429055

X-Message-Status: n:0

X-SID-PRA: Chase@update15.Chase.com

X-SID-Result: TempError

X-Message-Info: JGTYoYF78jGERDolRkZXK3aSevcWKGnNUwnJLp5ZCIU=

Received: from gt ([125.133.1.75]) by bay0-mc9-f3.bay0.hotmail.com with Microsoft SMTPSVC(6.0.3790.1830);

Fri, 7 Apr 2006 05:47:07 -0700

Delivered-To:

I really hate these scams. If you're bored, click on the link below and give them some FAKE info...

PHISHING LINK: https://Chase.com/update.php?account0429055

X-Message-Status: n:0

X-SID-PRA: Chase@update15.Chase.com

X-SID-Result: TempError

X-Message-Info: JGTYoYF78jGERDolRkZXK3aSevcWKGnNUwnJLp5ZCIU=

Received: from gt ([125.133.1.75]) by bay0-mc9-f3.bay0.hotmail.com with Microsoft SMTPSVC(6.0.3790.1830);

Fri, 7 Apr 2006 05:47:07 -0700

Delivered-To: Friday! Update: Inspiration, Reality, and What a Week! 04.07.2006