Tuesday, July 25, 2006

Check Out My New Site! Financialfreedumb.com

Still working on finalizing things, but take a look around...drop me a comment on the new site!

Thanks for bearing with me through this transition. My RSS feed is still having some problems so, it won't be updating until I get those issues worked out.

financialfreedumb.com

Monday, July 24, 2006

I'm Done...

Posting on blogspot.com that is.

I'm in the process of migrating over to my own site. During the migration of my posts and comments to Wordpress, all my formatting for my old posts on blogspot.com dissappeared. Luckily they show up fine in Wordpress.

So, I'm going to postpone any further posts on blogspot.com until I have my own site up and running. I should be done within the next few days. In the meantime, please enjoy my formatless posts in archive. :)

Sunday, July 23, 2006

My Home: Why Not Kansas? Free Land!

Not sure if you've seen this before, but it's been on the news a few times where I live. Free land in Kansas! Some restrictions, but for the most part, it's free.

But to each his/her own...I choose to live here in Hawaii. I would consider moving, maybe, if my family and friends weren't here...but I'm not sure I would be able to handle moving to the middle of Kansas. :/

Saturday, July 22, 2006

My 401k YTD Rate Of Return Is a Measily 0.4%. What's Yours?

My current rate of return (ROR) for my 401k year-to-date (01.01.2006 - 07.21.2006) is 0.4%. Not that great at all.

I'm curious, how are your 401k's doing? What's your ROR?

This is how ROR is calculated, per my 401k website:

Normally, you analyze an investment based on its Beginning Balance, its Ending Balance, and the schedule of Cash Flows between these 2 balances. Your Rate of Return is calculated as the Rate of Return for your particular Beginning Balance, Ending Balance, and schedule of Cash Flows. A compound daily rate of return is computed by testing different rates until one is found that increases (or reduces in the case of a loss) your beginning balance and all of your cash-flows to equal your ending balance within 0.00000000001%. Then the actual account performance during the investment period is calculated.

Friday, July 21, 2006

Bull Market? What Bull Market? Oh, That Kind of "Bull" Market & Egg-vertising

Since it's Friday, and tomorrow is Saturday, and the day after that Sunday, aka the WEEKEND, what's more appropriate than a little laugh to get everyone ready for 2 days to relax--I hope. If you don't get the weekend off, then just enjoy the chuckle, giggle, or laugh. If you don't get anything out of these articles, I'm sorry.

The first article is about the "bull market." If the article didn't have a picture, I wouldn't have guessed it's about a male cow...It was in the "Business" section of MSNBC.com. It's kind of funny...

The 2nd article talks about how CBS is taking advertising to a whole new level...Call it "egg-vertising." Too bad most people eat their eggs in the morning before primetime.

Wage Inflation Affecting India. Salaries Increase To $5,763.

I always wondered what do the folks in India get paid. Well, I found this article that talks about how India is dealing with wage inflation.

"During Infosys' earnings call the previous week, Infosys CEO Nandan Nilekani addressed the twin topics of wage inflation and employee attrition, saying that the company will increase starting salaries from $5,122 to $5,763, a 12.5 percent increase, on average."

Check it out in its entirety.

Thursday, July 20, 2006

Surprise! "Fun Fund" Opened At...GMAC.

Yep, I've opened my "fun fund" account, and it is at GMAC. Why? Well, it offers check writing, ATM card, a fairly low min ($500), supposed fast online transfers, and a pretty competitive interest rate.

Not to mention the process so far has been amazingly painless. I'll keep you all posted on the status of my GMAC account opening process.

I could not find any bonus/incentive offers though...and if you have, please don't post it! I don't want to find out after the fact. Thanks. :)

By the way, I did consider HSBC, but I already have an account there...Paypal, that would've been perfect, except for the possible problems with withdrawals and lack of FDIC insurance...finally, my credit union...I can still use the credit union, but I can avoid their horrid interest rates...

Wednesday, July 19, 2006

WARNING: Phishing Alert - eBay - But This One Is Different!

I have to admit, this phishing attempt is different. It's coming from a unassuming location. Who would think that a question from a fellow eBayer could be attempt to steal your info? On top of that, only the yellow "Respond Now" button leads to a false location.

For reference...Give them some fake info:

http://alice.ics.nara-wu.ac.jp/~chubo/ebays.html

Return-path:

For reference...Give them some fake info:

http://alice.ics.nara-wu.ac.jp/~chubo/ebays.html

Return-path:

Received: from spm02 (spm02)

by jem01

(Sun Java System Messaging Server 6.2-5.04 (built Jan 24 2006))

with ESMTP id <0j2o00ci4tq995b0@jem01> for ;

Wed, 19 Jul 2006 19:54:09 -1000 (HST)

Received: from mail.digitrain.ac.nz ([203.97.26.98])

by spm02 (8.13.6.20060614/8.13.6) with ESMTP id k6K5s0SX016030

for <>; Wed,

19 Jul 2006 19:54:07 -1000 (HST envelope-from donna@digitrain.ac.nz)

Received: by mail.digitrain.ac.nz (Postfix, from userid 1030)

id 6A349199C10D; Thu, 20 Jul 2006 16:16:51 +1200 (NZST)

Date: Thu, 20 Jul 2006 16:16:51 +1200 (NZST)

From: eBay

Subject: Question from eBay Member

To: undisclosed-recipients: ;

Message-id: <20060720041651.6a349199c10d@mail.digitrain.ac.nz>

MIME-version: 1.0

Content-type: text/html

Content-transfer-encoding: 8bit\r\n

X-PMX-Version: 5.2.0.264296, Antispam-Engine: 2.4.0.264935,

Antispam-Data: 2006.7.19.223932

Original-recipient: rfc822;

X-Perlmx-Spam: Gauge=XXX, Probability=30%, Report='PHISH_NO_HTML_TAG 1.25,

CTYPE_JUST_HTML 0.848, HTML_MIME_NO_HTML_TAG 0.8, PHISH_SUBJ_LOW 0.5, __CT 0,

__CTE 0, __CTYPE_IS_HTML 0, __HAS_MSGID 0, __MIME_HTML 0, __MIME_HTML_ONLY 0,

__MIME_VERSION 0, __PHISH_FROM 0, __PHISH_FROM2 0, __PHISH_SUBJ_PHRASE1 0,

__RUS_MIME_NO_TEXT 0, __SANE_MSGID 0'

For reference...Give them some fake info:

http://alice.ics.nara-wu.ac.jp/~chubo/ebays.html

Return-path:

For reference...Give them some fake info:

http://alice.ics.nara-wu.ac.jp/~chubo/ebays.html

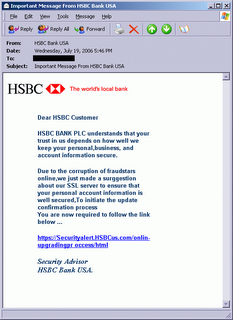

Return-path: WARNING: Phishing Alert - HSBC.com

This a phishing email received today. This is for reference only.

If you're bored give them some false info:

http://forum.schoschonen.com/event/official-security/upgrading/HSBC-US/login.htm

Return-path:

This a phishing email received today. This is for reference only.

If you're bored give them some false info:

http://forum.schoschonen.com/event/official-security/upgrading/HSBC-US/login.htm

Return-path: Off Topic: When Personal Beliefs Should Be Put Aside For the Greater Good...

I realize that people have beliefs, I have them too, but when the potential exists to help millions of people, I might have to reconsider putting my beliefs aside, just for a second, for the greater good of humankind.

That being said, I really am dissappointed that President Bush has decided to veto expanding embryonic stem cell research. No matter what we decide, other countries will move forward, leaving America in the dark.

Sorry my fellow citizens, this is a blow to the future of health sciences in America. Looks like we'll be on the sidelines as the next leap of health science occurs right before our eyes.

Those who stand with President Bush, are you not going to use the health advances discovered when cures tied to stem cell reasearch are found? What would you do if your father, mother, son, daugther, aunt, uncle's terminal disease could be cured? Would you put your beliefs aside then?

It's Going To Hurt When I Have To Pay My 0% Balances Off...Oh, and My Credit Card Limits.

Just looking over my current financials, and the almost $32,000.00 in credit card debt just sticks out. I don't like having debt, and as much as I know 0% is playing in my favor, it still kind of sucks knowing I have to pay it off eventually.

Anyway, I decided to take a look at my credit card limits (credit Claire @ Tired but happy) in hopes that my debt to credit limit ratio is fairly low. So here we go:

CC1: 14,400 (used: ~10,000, 0%)

CC2: 15,000

CC3: 9,000

CC4: 15,500

CC5: 16,000 (used: ~790, paid off monthly)

CC6: 22,000 (used: ~20,000, 0%) <- not good for credit score?

CC7: 16,200

Total Credit: $108,100

Well, that puts me at around 30% credit utilization. Unfortunately, I think it's not overall credit usage that affects your credit score, but utilization per credit card? Anyway, come the end of the year CC1 will become a zero balance credit card. CC6 is good until Sept 07.

Tuesday, July 18, 2006

Privatization = Better World

There was an interesting news clip on TV awhile ago on privatization and how it benefits the world. In essence, privatization equal ownership, ownership equals taking care of whatever it is being owned. Ultimately, this creates a sense of responsibility for the object being owned, and thus a better world.

Students of this high school were given one cup of Hershey's Kisses that "reproduce." For each Kiss left, you get one more at the end of each "round." In the first part of the experiment, each student group had one cup and told to take freely from the cup. In the end of the first part, there were no Kisses left or sometimes one or two--generally not sustainable. In the second part, a student in a group was given their own cup and told to take as many Kisses as they want and to give them away, half of the Kisses were left in the cups--sustainable.

The point of this exercise was that privatization helps because people/owners take better care of something they own, rather than land owned by a group or the public. I thought it was pretty interesting. What do you think? Should more parks and public places be owned by a private group?

Monday, July 17, 2006

My Home: Feedback From Readers Convinced Me To Make Some Changes...New Housing Requirements and Saving More For the Down.

My Home: A series about the home buying process through the eyes of a first time home buyer.

Sometimes reality sucks doesn't it? I've done some analysis on the real cost of ownership on my future home, and it hit me like a sledgehammer. Sorry Freedumb, try again. I got some great feedback (I was even told I'm "spoiled"). Before I go on, I'd like to refer to my post on why I want to live here in Hawaii. I realized I really needed to think about it again (an argument for blogging!). The most basic question I asked myself again, do I even really need to get a home right now? The answer? No. I'm not going to throw away my dreams of getting a home, rather I'm going to take a step back and change my requirements and my timeline. CityGirl has a great post about knowing thyself that would be worth checking out. Originally, I was excited to get a home because, well, it'd be my own place, the American Dream, blah blah blah. My dog would have a yard to run around in. I'd have something to take care of and watch as my investment grows. Then reality hit, and I got great feedback. I realized how much it would really cost to own what I want. I don't want to be living paycheck to paycheck, nor do I want to dig my own financial grave. So, that being said, I've decided to put off my home purchase even beyond next summer for as long as I can wait. Why? Well, I'd like to save as much as I can to have a bigger down payment so that I don't have to borrow too much. (Thanks NCN for making me think about credit a little more) I'd also like to observe the housing market longer. I've decided to do a couple of things: 1. Create a designated "house fund" that will be for my down payment. This is so that I'll have some extra cash for everything else. I can't drop my whole savings into the house, that would be dumb. (Madame X made me think about this a little more) 2. Reduce my requirements for my house. See below.

Originally, I wrote:

So, my monthly mortgage? @ 6.85% 30 yr loan would be $2,621.00/month. Now, to estimate everything else. I'm going to estimate on the high side.Home Owners Insurance - Assuming .5% per $100,000 in home value = $2,750.00/year Property Taxes - Assuming 1% per $100,000 in home value = $5,500.00/year

Maintenance - Assuming larger than average maintenance costs for first year = $10,000 for 1st year, $5,000 there after. This includes a lawn that might need some care...or new flooring...things I think I'll probably change out when I move in. Utilities - Cable, Phone, Electricity, Water - Based on how much my friend pays - $3600/year. Initial Purchases: Equipment, furniture, appliances - $5,000 for first year, $2,500 there after. 1st year total without mortgage = $26,850.00 (or $2,237.50 / month)

Thereafter = $19,350.00 (or $1,612.50 / month)

1st year monthly costs with mortgage = $4,858.50 per month

Monthly thereafter = $4,233.50 per month

I'm going to adjust costs to more realistic levels based on feedback received and comments from friends and family. With the same monthly mortgage @ 6.85% 30 yr loan = $2,621.00/month.

Sometimes reality sucks doesn't it? I've done some analysis on the real cost of ownership on my future home, and it hit me like a sledgehammer. Sorry Freedumb, try again. I got some great feedback (I was even told I'm "spoiled"). Before I go on, I'd like to refer to my post on why I want to live here in Hawaii. I realized I really needed to think about it again (an argument for blogging!). The most basic question I asked myself again, do I even really need to get a home right now? The answer? No. I'm not going to throw away my dreams of getting a home, rather I'm going to take a step back and change my requirements and my timeline. CityGirl has a great post about knowing thyself that would be worth checking out. Originally, I was excited to get a home because, well, it'd be my own place, the American Dream, blah blah blah. My dog would have a yard to run around in. I'd have something to take care of and watch as my investment grows. Then reality hit, and I got great feedback. I realized how much it would really cost to own what I want. I don't want to be living paycheck to paycheck, nor do I want to dig my own financial grave. So, that being said, I've decided to put off my home purchase even beyond next summer for as long as I can wait. Why? Well, I'd like to save as much as I can to have a bigger down payment so that I don't have to borrow too much. (Thanks NCN for making me think about credit a little more) I'd also like to observe the housing market longer. I've decided to do a couple of things: 1. Create a designated "house fund" that will be for my down payment. This is so that I'll have some extra cash for everything else. I can't drop my whole savings into the house, that would be dumb. (Madame X made me think about this a little more) 2. Reduce my requirements for my house. See below.

| Original requirements | My revised requirements: |

| ~ 5000-10000 sqft lot size ~ 1200-1500 sqft living space - A decent sized yard, with a portion fenced off for Brownie to run around. - Early mail delivery. Yes, I like having my mail delivered early! - Hands free faucet in the kitchen. - Target price of around $500-650K - Off major streets - Level lot - 2 car garage - Fairly up to date electrical system, if not then the ability to upgrade easily. - 10' ceilings - 4 Bedrooms (Maybe a split, two level house, so I can rent one and live in another) - Wired for CAT 6E. I'm pretty sure this is something I'll have to setup myself. - I would like a location about 15 mins from town. - Friendly neighbors...who wouldn't want that! - Decent amount of street parking - Breezy and cool location - Fairly close to freeway | ~ 4000-6000 sqft lot size ~ 800-1200 sqft living space - Target price of around $450-600K - Off major streets - Level lot - 2 car garage - Fairly up to date electrical system, if not then the ability to upgrade easily. - 2 Bedrooms - I would like a location about 15 mins from town. - Decent amount of street parking - Breezy and cool location - Fairly close to freeway |

1st year total without mortgage = $19,350.00 (or $ 1,612.50 / month) Thereafter = $15,350.00 (or $ 1,279.17/ month) By the way, I am considering once a year fees as part of my monthly expenses just for a better picture of my total expenses. 1st year monthly costs with mortgage = $ 4,233.50 / month Monthly thereafter = $ 3,900.17 / month Hmmm, still a little high, so I've increased my down payment to $200k, which would reduce my mortgage loan to $350k. My new monthly mortgage @ 6.85% would be $2,293.00 / month. With the same other expenses I wrote about before: 1st year monthly costs with mortgage = $3,905.50 / month Monthly thereafter = $ 3,572.17 / month Better. Still high, but at least that's manageable considering my current income. I'll keep trying to save even more for a down payment. The more the better. The journey continues...Home Owners Insurance = $2,750.00/year Property Taxes = $5,500.00/year Maintenance = $5,000 for 1st year, $2,500 there after. Utilities = $3600/year. Initial Purchases: Equipment, furniture, appliances - $2,5000 for first year, $1,000 there after.

How Much My Education Costed...My Entire Education From K Through College.

So I was curious, everyone talks about the price of a college education, but ever wondered what the cost is to be educated through a lifetime? Having gone to private schooling from K-12 and then a public state university, my education costed a little more than attending a public school.

K-8, small Catholic school: ~$1,000.00/year (averaged over 9 years) + $2,000.00 for summer fun/school.

9-12, a different Catholic school: $4,000.00/year + $1,500.00 for summer school.

College, state university (removed my scholarship): $2,000.00/year (averaged over 5 years) + $1,200.00 for summer school.

Total? $39,700.00 for my total education. Not adjusted for inflation.

That's a pretty penny. Now if I consider my scholarship, my total education costs drop to: $15,700.00. I hope my kids can get a scholarship! (I don't have any, but if I do in the future)

Saturday, July 15, 2006

Being In Debt = Being a Slave?

First off, I commend and respect NCN's stance on refusing credit. The principle is good, and I agree many people in today's society are often in over their heads in debt. But putting all formlities aside and being honest, that is the individual's fault, and no one else's fault but their own. There are circumstances where I believe the decision to go into debt might have been extremely difficult, and I'm in no way trying to put that lightly. I believe that some honest hardworking people who are trying to now pay down their debt are "in over their heads," and I hope the support and help is there to help them get out. I'm not being insensitive, just stating the truth.

Now if a creditor took advantage of people by using confusing terms, tricks, lying, etc. that is a whole different story, and not one I'll get into.

I believe there's a basic fault in the premise that having credit equals being someone else's slave, because as people, we all owe someone something, regardless of how much we think we made it on our own. I'm not talking just money here obviously, could be time and labor to help move, could be someone looking after your shopping cart while you went to find your kid, could be anything. My point is just because you owe someone something does not make you their slave. I sometimes pick up the tab for lunch or dinner for my friend knowing that later down the line they will do the same. I don't think of them as slaves, and if I happen to pick up another tab before they do, I don't count. If that is the case then, you my friend, need to find new friends.

Here's a statement I have a problem with:

First off, I commend and respect NCN's stance on refusing credit. The principle is good, and I agree many people in today's society are often in over their heads in debt. But putting all formlities aside and being honest, that is the individual's fault, and no one else's fault but their own. There are circumstances where I believe the decision to go into debt might have been extremely difficult, and I'm in no way trying to put that lightly. I believe that some honest hardworking people who are trying to now pay down their debt are "in over their heads," and I hope the support and help is there to help them get out. I'm not being insensitive, just stating the truth.

Now if a creditor took advantage of people by using confusing terms, tricks, lying, etc. that is a whole different story, and not one I'll get into.

I believe there's a basic fault in the premise that having credit equals being someone else's slave, because as people, we all owe someone something, regardless of how much we think we made it on our own. I'm not talking just money here obviously, could be time and labor to help move, could be someone looking after your shopping cart while you went to find your kid, could be anything. My point is just because you owe someone something does not make you their slave. I sometimes pick up the tab for lunch or dinner for my friend knowing that later down the line they will do the same. I don't think of them as slaves, and if I happen to pick up another tab before they do, I don't count. If that is the case then, you my friend, need to find new friends.

Here's a statement I have a problem with:

I'm pretty radical. I refuse to borrow money. I will not borrow money from anyone, not even a friend or a relative. I will humbly accept money as a gift, or proudly take money as salary for a job that I have done, but I will not borrow money. I will not borrow money for a car, for a house, for a boat, for a sandwich. I will not borrow money... Why? Because, I refuse to be anyone's slave...But come on, borrowing money for a sandwhich equals being a slave? That definitely is a little too radical for me.

I will not bow down to the gods of CitiBank or Bank of America or Ford Motor Credit. I do not care how they "reward" me, entice me, trick me, or invite me. I will not be seduced by their promises and their plans for my future. I have a brain of my own. No amount of "cash back" is worth giving up my freedom.CitiBank, BofA, and Ford Motor Credit are FAR from gods. The foundation of freedom in America runs much too deep for even the hands of CitiBank to dig up.

Friday, July 14, 2006

Off Topic: Getting Off Blogger and Blogspot.com - A Mini-Guide

Alright, for those interested in moving off of Blogger.com (I hope I don't lose my account lol), Flexo over at Consumerism Commentary is generously offering 5 lucky bloggers their chance at having their own domain name hosted! FYI, Domain name registration not included, unless you'd like to pay Flexo to have him set it up for you. It may already be too late though, since it was first come first serve I believe. Go there and read the terms he set out...

I haven't setup hosting for Financial Freedumb yet, but I am thinking about doing it in the future. I'm slowly in the process of moving over already actually. I don't want to impact my readers too much in one shot, so I'm taking it slowly. Here are my plans, if you have any tips on minimizing the impact on my readers and my exposure, please let me know!

1. I'm using Feedburner. This way, I can point my feed to a new "source" without affecting the original RSS location. Readers already subscribed to my blog should not be affected, no need to resubscribe. The last thing I need is to lose 1 of my 10 subscribers! :D

2. I've purchased the domain name, financialfreedumb.com, and have it redirected to my http://financialfreedumb.blogspot.com. This way, I can always reference financialfreedumb.com as my blog address. Then when the switch over happens, it should be fairly painless.

3. I plan on posting a few times before the switch over to request bloggers to switch over links to http://www.financialfreedumb.com instead of http://finacialfreedumb.blogspot.com.

4. Finally, I plan to keep my blogger account alive, but change my template to point users to my new site. All old links will work, but notify readers of my new location.

That's it. If all goes well, impact to my readers should be minimal, and that's goal number one. Can you tell I work in customer service and have been brainwashed for long enough?

If you're interested, please signup through my referral link...I host at dreamhost.com, and they're awesome!

Alright, for those interested in moving off of Blogger.com (I hope I don't lose my account lol), Flexo over at Consumerism Commentary is generously offering 5 lucky bloggers their chance at having their own domain name hosted! FYI, Domain name registration not included, unless you'd like to pay Flexo to have him set it up for you. It may already be too late though, since it was first come first serve I believe. Go there and read the terms he set out...

I haven't setup hosting for Financial Freedumb yet, but I am thinking about doing it in the future. I'm slowly in the process of moving over already actually. I don't want to impact my readers too much in one shot, so I'm taking it slowly. Here are my plans, if you have any tips on minimizing the impact on my readers and my exposure, please let me know!

1. I'm using Feedburner. This way, I can point my feed to a new "source" without affecting the original RSS location. Readers already subscribed to my blog should not be affected, no need to resubscribe. The last thing I need is to lose 1 of my 10 subscribers! :D

2. I've purchased the domain name, financialfreedumb.com, and have it redirected to my http://financialfreedumb.blogspot.com. This way, I can always reference financialfreedumb.com as my blog address. Then when the switch over happens, it should be fairly painless.

3. I plan on posting a few times before the switch over to request bloggers to switch over links to http://www.financialfreedumb.com instead of http://finacialfreedumb.blogspot.com.

4. Finally, I plan to keep my blogger account alive, but change my template to point users to my new site. All old links will work, but notify readers of my new location.

That's it. If all goes well, impact to my readers should be minimal, and that's goal number one. Can you tell I work in customer service and have been brainwashed for long enough?

If you're interested, please signup through my referral link...I host at dreamhost.com, and they're awesome!

They have this "one-click" install which lets you setup Wordpress. Very convenient!

Or just pay Flexo. :) Maybe you can convince him to start a "fee-for-migration service."

They have this "one-click" install which lets you setup Wordpress. Very convenient!

Or just pay Flexo. :) Maybe you can convince him to start a "fee-for-migration service."

Updated Doggie Costs

If you haven't read about Brownie's not so fun encounter with d-i-a-r-r-h-e-a, check it out. He had an unplanned vet visit due to it, but he's much better now. Poor guy had the runs like I hope no one ever has to go through. Main post has been updated if you're interested in seeing where all the money spent on Brownie has gone. Total cost to date: $4,301.79.

Thursday, July 13, 2006

My "Fun Fund" Will Not Be At Emigrant. Here's Why.

So in deciding where to open my "fun fund," originally Emigrant had been my favored institution, but recently, I read a post on Bank Deals that stated, Emigrant downgraded to 2 stars. No big deal right? They are FDIC insured. Ummm, not completely.

If I have a choice, I'm not going to put my money in a bank that might be insolvent, however unlikely that may be. Of course, I haven't done a ton of research into Emigrant, but really, I'm not looking to do so. I just want an easy place to put my money to spend, and one that I don't have to worry about. Even if it's not completely true, there has to be some truth behind it. That being said, my current consideration list is:

- My current credit union's savings account.

A fairly low savings rate, but it's convenient and easily accessible. I can also get traveler's checks for free.

- Paypal (thanks LAMoneyGuy).

Might be a good mix between a full fledged online bank and my local credit union. Transfer is much quicker than HSBC, that's for sure. Plus no minimum, and I can use it to buy things online, although I'd still probably use my credit card. So that point is moot. And rates are very competetive...I was surprised actually. At 4.95%, that's pretty impressive.

I'm going to be out playing a round of golf today (yes, I'm taking a half day from work...I am not play hookie). I haven't hit a golf ball in over a year, but this will be for a school benefit, which is why I'm going. It should be very interesting. I won't be posting anymore until later today if anything.

Wednesday, July 12, 2006

Silver, Buffalo & Wheat In Your Pocket?

Did you know that some valuable coins are still in circulation today? They could even be in your pocket!

I just thought I'd share the little I know about coins...there's a huge world of coin collecting I'm not going to go into. I don't know enough, and as much as I would love to get into it, I don't think I have enough time right now. Although, had I invested in coins earlier, considering metal values today, I would be one rich dude.

Let's start with the penny: Ah it's a penny. Look for odd looking ones. Even if composed of rare metals, it's pretty small so there's not much in there. Although, if you do find a 1943 copper penny, that penny could be worth $200,000.00+!!

The nickel: Look for the buffalo or nickels dated from 1942 - 1945, known as the wartime nickels. These are composed of 35% silver! I think early nickels are composed of nickel...that's why they are not worth that much except for the buffalos and the wartime nickels.

The dime: If you have a dime dated 1964 or earlier, keep it. Could be worth something. Unless you have a 1965 silver dime, which were made with silver by mistake, it could be worth more than $9000!

The quarter: Same here...the magic year is 1964. 90% silver! If you find a quarter severly misstamped...KEEP IT! It's worth $400-3000 USD!

Check this post out if you haven't already... So there you have it. Dump out the change in your pockets, sift through the jars in your homes, empty out those ash trays full of coins in your cars. You could strike it rich! If not, roll them up or go to a coin counting machine...They earn no interest sitting there. Oh and if you find a super valuable coin, be sure to send Freedumb a piece of the change. I'll write up a thank you letter for the world to see on my blog. Trust me, the exposure on my blog is priceless. ;)

Who Still Keeps Money Under the Mattress?

Just reading something at Consumerism Commentary, and the question popped into my head, "Who still keeps money under the mattress (or some similar hiding area)?"

I have a couple hundred, maybe three hundred at most, lying around in various places, but honestly, I only remember the location of a $20 bill. I put them there mainly because, well, I just needed someplace to put them, and they stayed there. Some of my cash has been stashed away since high school.

Do you hide cash away?

Just reading something at Consumerism Commentary, and the question popped into my head, "Who still keeps money under the mattress (or some similar hiding area)?"

I have a couple hundred, maybe three hundred at most, lying around in various places, but honestly, I only remember the location of a $20 bill. I put them there mainly because, well, I just needed someplace to put them, and they stayed there. Some of my cash has been stashed away since high school.

Do you hide cash away?

Tuesday, July 11, 2006

My Home: Home Price Is One Thing, What About Everything Else?

My Home: A series about the home buying process through the eyes of a first time home buyer.

I've set my budget, but that was just for the price of the home. Just as important as figuring out how much of a house I can afford is figuring out how much I'll need to do everything else associated with a house. Consider home owners insurance, maintenance, upgrades, taxes, etc. I'm going to try and estimate these costs to give me an idea of what it'll really cost me to own a home, and how it'll impact my everyday life. I don't want to own a home but have no money left for food and other necessities. Not to mention, I don't want more debt on top of my mortgage. So what should I expect to really spend per month to be a home owner? Well, let's assume I bought a $550k house...I put $150k down, and financed $400k. Let's also assume the closing costs, fees, etc. that are part of the home buying purchase were included in the loan. So, my monthly mortgage? @ 6.85% 30 yr loan would be $2,621.00/month. Now, to estimate everything else. I'm going to estimate on the high side.Home Owners Insurance - Assuming .5% per $100,000 in home value = $2,750.00/year

Property Taxes - Assuming 1% per $100,000 in home value = $5,500.00/year

Maintenance - Assuming larger than average maintenance costs for first year = $10,000 for 1st year, $5,000 there after. This includes a lawn that might need some care...or new flooring...things I think I'll probably change out when I move in.

Utilities - Cable, Phone, Electricity, Water - Based on how much my friend pays - $3600/year.

Initial Purchases: Equipment, furniture, appliances - $5,000 for first year, $2,500 there after.

1st year total without mortgage = $26,850.00 (or $2,237.50 / month)

Thereafter = $19,350.00 (or $1,612.50 / month)

1st year monthly costs with mortgage = $4,858.50 per month

Monthly thereafter = $4,233.50 per month

WOW!

If my house were $650k, and I financed $500k. Mortgage would be $3,276.00. Tack on the additional costs, and my first year's monthly costs would become $5,513.50, and $4,888.50 thereafter per month. WOW! Did I already say that? Am I missing something? I know I went high...but dang! Are my estimates way off the mark? So on my next post, I'll tackle the question, can I really afford that?

I've set my budget, but that was just for the price of the home. Just as important as figuring out how much of a house I can afford is figuring out how much I'll need to do everything else associated with a house. Consider home owners insurance, maintenance, upgrades, taxes, etc. I'm going to try and estimate these costs to give me an idea of what it'll really cost me to own a home, and how it'll impact my everyday life. I don't want to own a home but have no money left for food and other necessities. Not to mention, I don't want more debt on top of my mortgage. So what should I expect to really spend per month to be a home owner? Well, let's assume I bought a $550k house...I put $150k down, and financed $400k. Let's also assume the closing costs, fees, etc. that are part of the home buying purchase were included in the loan. So, my monthly mortgage? @ 6.85% 30 yr loan would be $2,621.00/month. Now, to estimate everything else. I'm going to estimate on the high side.

When To Exercise Stock Options?

Monday, July 10, 2006

Free Hat Survey For WallSt.Net.

Never heard of this site before, but just filled out a form for a free hat. If you're interested, here's the link. Looks like an interesting site...Survey promotion worked...I just registered even though it wasn't required.

My Job Kind Of Sucks, But I Still Do It. How and Why.

If you're like me, then you really don't enjoy your job, but then again, you really don't hate it either. It's just, well, okay. There are up days and down days...seemingly more down days. But my benefits are good...pay, working from home, and my coworkers. But customer support is probably one of the least glorious of all technical positions, right below testing in my opinion. Of course, poor customer support means lots of lost revenue and customers, so it really is important, just not well recognized. Sales and development always seem to get the recognition, but my post is not about the job itself, but how I deal with it.

So how do I deal with the lowly drudgery of dealing with other people's problems everyday?

When I graduated from college, I worked 8-6 at the office, and then went home and did more work. I even worked on the weekends. My boss loved me, but I swear my mind has lost a few gears since then. I can't seem to keep track of as many things, and this is only 5 years ago! So, in order to keep my sanity, I had to take a look at my life and what is important.

First of all, I take deep breaths, and I don't let people aggravate me. It's not my problem, but it is my problem. I do what I can, when I can. I work smarter, not harder. Don't get me wrong, I still do a good, thorough job. But I won't hit myself in the head trying to perfect everything I do. I've come to accept a few slip ups here and there. In the past, I wouldn't have. I understand the fact that if I want to be the best in my field, I can't accept slip ups, but that's not my goal. My life takes priority over my job.

My work is just as good as it was, but now I put in 25% less effort. As time goes on, I'm thinking I can get that down to 50% so that I can spend more time enjoying life.

If you can't take a deep breath and see the big picture, then, my advice would be to take a day off from work just to do nothing except think about what is important. Put a few signs on your office wall reminding you of these. You only live once, and so you might as well make the most of it. It's not all about work and money. Funny, growing up, I heard the exact opposite, life is not all about play. How the tables turn.

11 Billionaires and a Few CEOs Under 35 Years Old!

"Among the 793 billionaires Forbes found in 2006, only 11 of them, or 1 percent, were under the age of 35. Of those, five inherited their fortunes, like Prince Albert. The other six created their own wealth."

Nice to hear that 6 actually created their own wealth, and pretty darn impressive!

Read first article.

This next one talks about CEOs under 35.

Sunday, July 09, 2006

Hey, I'll Sell You 5 Pennies For 6 Cents!

Now that's a deal! The US Mint is considering dropping it. Coined, no pun intended, the "nuisance coin," it's funny that only a third of Americans want to actually get rid of them.

So next time you have a penny, keep in mind, you probably could get more for it by melting it down than taking it to the bank. Just be sure to also keep in mind that it's illegal to destroy federal property.

Read the article.

Now that's a deal! The US Mint is considering dropping it. Coined, no pun intended, the "nuisance coin," it's funny that only a third of Americans want to actually get rid of them.

So next time you have a penny, keep in mind, you probably could get more for it by melting it down than taking it to the bank. Just be sure to also keep in mind that it's illegal to destroy federal property.

Read the article.

Saturday, July 08, 2006

Opening Up a "Fun Fund," Can You Recommend Which Savings To Go With?

Alright, I have a hard time spending money, which is great, but this often leads to aggravation...of myself. You see when it comes time to buy gifts or spend money during a vacation, I just can't do it. I always think about how much it's impacting my net worth, how much I've worked to earn that money, and everything else that goes with spending money. So in order to combat that problem, I've decided to open a "fun fund." This money will be allocated to be spent on gifts, for others and myself, and on vacations, nothing else. Well, if necessary, an emergency emergency fund. But really the whole point of this account is to have it at 0 at least a few times a year. That's right a zero balance in a savings account.

This fund will not be tracked in my net worth. It will be considered an expense before it's even actually spent.

My requirements for this fund is that it is online, no minimum or very low (less than $100), has a fairly decent return, and can perform regular automatic deductions from another account. I am planning on funding this account with an initial $500.00 and then $100 per month thereafter, but that could change...what do you think is reasonable?

I currently have two online savings account one with ING and the other HSBC. I guess having too many account is not a bad thing as comments on my previous post indicates. So which online savings bank to go with?

Emigrant?

Citibank?

VirtualBank?

GMAC?

Some comparisons I've found:

MyMoneyBlog

Bankdeals

I'd like to sign up for one that gives me some incentive to join. Right now I'm leaning towards Emigrant, just because they are the last of the "top 3" online savings accounts I don't have an account with yet. It also meets the requirements I stated above and MyMoneyBlog is giving away a signup bonus.

Please leave me some feedback. Do you think this is a bad/good idea? I'll let you know which I've selected in a few days.

Alright, I have a hard time spending money, which is great, but this often leads to aggravation...of myself. You see when it comes time to buy gifts or spend money during a vacation, I just can't do it. I always think about how much it's impacting my net worth, how much I've worked to earn that money, and everything else that goes with spending money. So in order to combat that problem, I've decided to open a "fun fund." This money will be allocated to be spent on gifts, for others and myself, and on vacations, nothing else. Well, if necessary, an emergency emergency fund. But really the whole point of this account is to have it at 0 at least a few times a year. That's right a zero balance in a savings account.

This fund will not be tracked in my net worth. It will be considered an expense before it's even actually spent.

My requirements for this fund is that it is online, no minimum or very low (less than $100), has a fairly decent return, and can perform regular automatic deductions from another account. I am planning on funding this account with an initial $500.00 and then $100 per month thereafter, but that could change...what do you think is reasonable?

I currently have two online savings account one with ING and the other HSBC. I guess having too many account is not a bad thing as comments on my previous post indicates. So which online savings bank to go with?

Emigrant?

Citibank?

VirtualBank?

GMAC?

Some comparisons I've found:

MyMoneyBlog

Bankdeals

I'd like to sign up for one that gives me some incentive to join. Right now I'm leaning towards Emigrant, just because they are the last of the "top 3" online savings accounts I don't have an account with yet. It also meets the requirements I stated above and MyMoneyBlog is giving away a signup bonus.

Please leave me some feedback. Do you think this is a bad/good idea? I'll let you know which I've selected in a few days.

Friday, July 07, 2006

What Can 28 Million Buy You In Las Vegas?

Not much in my opinion:

Bedrooms: 4

Bathrooms: 5 full baths, three half baths

Size: 12,041 square feet

Yikes! Not to mention monthly homes sales fell 24.8% compared to last year! Wow. Read the article in its entirety here.

Not much in my opinion:

Bedrooms: 4

Bathrooms: 5 full baths, three half baths

Size: 12,041 square feet

Yikes! Not to mention monthly homes sales fell 24.8% compared to last year! Wow. Read the article in its entirety here.

What If the US Went Cashless? The World?

Laws of Finance does it...SingleMa does it, and I do it. So why doesn't everyone do it? I'm not sure. Hard to break old habits I guess?

I love change--for the most part anyway. The idea of a cashless society intrigues me, almost as much as national sales tax.

The reasons are many, but here are some I've thought of. It would have a huge impact on society, a positive one I think. Of course we eliminate some evils, and we introduce some new ones, but hey nothing is perfect. We just strive to be.

PROS

+ Imagine all those tax dollars saved because we no longer have to print out money. Nor do we have to save, store, destroy old currency.

+ It will probably reduce petty crime. Stores can no longer be robbed for money. Drug deals would have to become more sophisticated. Prositution would be a little awkward. Illegal purchases made by younger kids could be automatically declined. Couterfitting will probably be eliminated, uhhhh, since there's no money to counterfit!

+ No more handling paper money means a much more hygenic society. Money has traces of bacteria, drugs and a host of other germs. Take a look at this...Dirty Money.

CONS

- Government/Companies running cashless systems would have a tremendous amount of information on individual habits.

NEUTRAL

- Affects on industries could be huge. Banks could change dramatically, retail would be simplified, coins would no longer have to be counted. The list can go on for miles. Society will change drammatically. This could be a pro too, but the impact on careers will be mixed.

We can dream can't we? Bold moves like going cashless, a national sales tax, green cars, smaller portion sizes at restaurants, smokeless society, changing to metric, investing in medical research all takes, as SingleMa points out, vision. I hope I get to see a few of these introduced before I die. So pick something folks and go for it!

Laws of Finance does it...SingleMa does it, and I do it. So why doesn't everyone do it? I'm not sure. Hard to break old habits I guess?

I love change--for the most part anyway. The idea of a cashless society intrigues me, almost as much as national sales tax.

The reasons are many, but here are some I've thought of. It would have a huge impact on society, a positive one I think. Of course we eliminate some evils, and we introduce some new ones, but hey nothing is perfect. We just strive to be.

PROS

+ Imagine all those tax dollars saved because we no longer have to print out money. Nor do we have to save, store, destroy old currency.

+ It will probably reduce petty crime. Stores can no longer be robbed for money. Drug deals would have to become more sophisticated. Prositution would be a little awkward. Illegal purchases made by younger kids could be automatically declined. Couterfitting will probably be eliminated, uhhhh, since there's no money to counterfit!

+ No more handling paper money means a much more hygenic society. Money has traces of bacteria, drugs and a host of other germs. Take a look at this...Dirty Money.

CONS

- Government/Companies running cashless systems would have a tremendous amount of information on individual habits.

NEUTRAL

- Affects on industries could be huge. Banks could change dramatically, retail would be simplified, coins would no longer have to be counted. The list can go on for miles. Society will change drammatically. This could be a pro too, but the impact on careers will be mixed.

We can dream can't we? Bold moves like going cashless, a national sales tax, green cars, smaller portion sizes at restaurants, smokeless society, changing to metric, investing in medical research all takes, as SingleMa points out, vision. I hope I get to see a few of these introduced before I die. So pick something folks and go for it!

Friday! Update: Fantasy Football, Ads = Sell Out? 07.07.2006

Alright, this will be a short and sweet Friday! Update. Read my post on fantasy football.

Only bloggers in debt are allowed to "sell-out." Would you agree? I don't. EDIT: I want to clarify that Him @ Make Love, Not Debt argues that getting paid to write about a specific topic by payperpost.com is really just another form of spam and "selling out." I agree somewhat, if you get paid to write about something, that may be a form of selling out, but I think you have to be fair and really weigh the perspective the writer is coming from. If they just falsify their writeup to make money, then yeah, that's not good. But heck, if someone came up to me and asked to take a look and write something for a fee, I'd do it. It'd be honest though...if they don't agree to that condition, then I wouldn't do it. Also, I'm not going to even sign up or look through payperpost.com. If someone makes the effort to contact me, that's a different story.

What do you think of my new layout?

Have a great weekend!

-FF

(I told you)

Thursday, July 06, 2006

Housekeeping - Blogs Removed

I guess there comes a time when people lose interest, find other things more important, can't dedicate time...whatever the reason, everytime I find blogs that haven't been updated in awhile, it's kind of a shock. These 4 blogs were there before mine, and I found some good posts on them. If you have some time check them out. Just because I'm taking them off the list, doesn't mean they are not great reads. They still are. Except for Gay Finance because well...the blogs not there anymore!

If any of you come back, please let me know. I'd like to add you back on to my blogroll. Whatever you are doing now, best of luck to ya!

Financial Train Wreck

Gay Finance Blog

Kirby On Finance

Young Professions Financial Blog

I plan on doing this quarterly or so from now on...

Do You Look Like Your Net Worth?

A couple of my friends look a lot more expensive than they are financially worth. I'm just talking financially here...As friends, they're worth more than money could buy. So don't go all crazy on me for this post.

What do I mean? Well, they buy expensive clothes and bags, but they are in debt and live paycheck to paycheck. To each his/her own, but that brought up a question in my mind, do you look like how much you're financially worth? I'm just talking about the clothes, car, and entertainment kind of worth. I know I don't.

For example, some people may eat out at expensive restaurants, drive expensive cars, but be heavily in debt.

I like wearing old shirts, not new old shirts either...Shirts that I have owned for almost 10 years now. They're so soft and comfortable. I like leaving my hair uncombed. Considering I work at home, I guess it's okay. Some people would be embarrased, and call me a slob. I don't think I am. I clean up when I need to, but I'm not overly concerned with how I look. Hmmm, that could attribute to why I'm single. Hah. But hey, I'm not complaining, I like single life.

A while back, Him @ Make Love, Not Debt, wrote Metrosexual Expenses. I was pretty shocked...I'm looking for the cheapest haircuts.

So, do you look like your net worth?

A couple of my friends look a lot more expensive than they are financially worth. I'm just talking financially here...As friends, they're worth more than money could buy. So don't go all crazy on me for this post.

What do I mean? Well, they buy expensive clothes and bags, but they are in debt and live paycheck to paycheck. To each his/her own, but that brought up a question in my mind, do you look like how much you're financially worth? I'm just talking about the clothes, car, and entertainment kind of worth. I know I don't.

For example, some people may eat out at expensive restaurants, drive expensive cars, but be heavily in debt.

I like wearing old shirts, not new old shirts either...Shirts that I have owned for almost 10 years now. They're so soft and comfortable. I like leaving my hair uncombed. Considering I work at home, I guess it's okay. Some people would be embarrased, and call me a slob. I don't think I am. I clean up when I need to, but I'm not overly concerned with how I look. Hmmm, that could attribute to why I'm single. Hah. But hey, I'm not complaining, I like single life.

A while back, Him @ Make Love, Not Debt, wrote Metrosexual Expenses. I was pretty shocked...I'm looking for the cheapest haircuts.

So, do you look like your net worth?

Fantasy Football and Some Tips From Freedumb So That You Can Make Some Money

THANK YOU FOOTBALL GODS! The season is upon us! I love football. Pro more so than college. And by the way, I'm not talking about soccer, the other football. Rather, I'm talking about NFL football. Football is going to start hitting high gear in a few months, and there's no other sport like it. Especially when it comes to making money! So many ways to place friendly wagers, but by far fantasy football is the most addicting and exciting form of "fantasy" sports. The sport just fits well...scoring, the amount and frequency of games, the technicalities. It's not too confusing like fantasy baseball can be, and it's not overwhelming due to the number of games like fantasy baseball or basketball.

I'm in a league for almost 8 years with a group of friends. It's great fun.

Being in a group with your friends makes fantasy even better. I don't think I would've kept in touch with many of them without football. Okay enough of that, on to the good stuff! How does fantasy football work?

Fantasy football leagues are generally 8, 10 or 12 team leagues. Where each team composed of various football players from different skill areas. Each team should be owned by different owners, otherwise it could make for some cheating. These teams then compete throughout the football regular season, usually a fantasy football season is 14-15 weeks long, ending a couple weeks before the end of the regular football season. This is mainly because the end of the season is bad for fantasy football players as many teams will bench players or adjust the normal play times based on whether that game is important or not. For example, if a team is 14-1, and already locked the division's top spot in the playoffs, then why risk injury? Thus they bench their star players early. This is bad for fantasy football teams. I'll explain why later.

What are skill areas and how does the scoring work?

Each week you face another owner. Each owner manages a team of fantasy football players. The number of players varies according to league rules.

For example, league ABC consists of 8 fantasy football players. The players are broken down like this: 1 Quarterback, 2 Running backs, 2 Wide Receivers, 1 Tight End, 1 Kicker, and 1 Team Defense = 8 players. These 8 players get points, and the sum of the points equals your team points. Whichever team in the head-to-head competition that has the higher point total wins for that week.

Scoring varies according to league rules as well. One simple example would be, 6 pts for each touchdown (passing, rushing, or receiving), 1 point for each 10 yards rushed or caught, etc.

Okay, so how do I get my team? Do I just get to pick players?

Sort of. Just like real football, there's usually a draft. However, there are also variations here, like a auction system draft. Most drafts, though, are typically setup as "rounds," where each round consists of each owner picking one pick. The order of this draft is pre-determined, and the position you have can greatly affect your team.

For example:

Round 1

1 pick: Owner A

2 pick: Owner B

3 pick: Owner C

4 pick: Owner D

5 pick: Owner E

6 pick: Owner F

7 pick: Owner G

8 pick: Owner H

Round 1

9 pick: Owner H

10 pick: Owner G

11 pick: Owner F

12 pick: Owner E

13 pick: Owner D

14 pick: Owner C

15 pick: Owner B

16 pick: Owner A

Notice how the draft order "snakes." This is a typical draft system.

So now you are ready to get started! Okay, maybe not, but hey I'm not done yet...so keep reading. First off, start by checking out a few of the "free" fantasy football sites, like Yahoo! Sports Fantasy. Just sign up and join up a random league. It's a great way to learn and meet people. Of course use Google!

Some sites to check out:

http://www.fftoday.com/

http://games.espn.go.com/ffl/frontpage

http://football.fantasysports.yahoo.com/f1

http://kffl.com/

http://www.profootballweekly.com/PFW/default.htm

My tips:

- Get a couple magazines. The Fantasy Football Index is a must for any fantasy football player. So get this at least. Buy it online to avoid sales tax and get free shipping. The second magazine is not a must have, but I like the Pro Forecast and Pro Football Weekly. Which one to get is your decision. I don't think it makes much sense to get more than 2 magazines though. Keep in mind by the 4th week in the regular season, most of information is outdated anyway. You'll be using it as a reference and for info on backup players and team schedules.

- Your draft strategy should be based upon:

THANK YOU FOOTBALL GODS! The season is upon us! I love football. Pro more so than college. And by the way, I'm not talking about soccer, the other football. Rather, I'm talking about NFL football. Football is going to start hitting high gear in a few months, and there's no other sport like it. Especially when it comes to making money! So many ways to place friendly wagers, but by far fantasy football is the most addicting and exciting form of "fantasy" sports. The sport just fits well...scoring, the amount and frequency of games, the technicalities. It's not too confusing like fantasy baseball can be, and it's not overwhelming due to the number of games like fantasy baseball or basketball.

I'm in a league for almost 8 years with a group of friends. It's great fun.

Being in a group with your friends makes fantasy even better. I don't think I would've kept in touch with many of them without football. Okay enough of that, on to the good stuff! How does fantasy football work?

Fantasy football leagues are generally 8, 10 or 12 team leagues. Where each team composed of various football players from different skill areas. Each team should be owned by different owners, otherwise it could make for some cheating. These teams then compete throughout the football regular season, usually a fantasy football season is 14-15 weeks long, ending a couple weeks before the end of the regular football season. This is mainly because the end of the season is bad for fantasy football players as many teams will bench players or adjust the normal play times based on whether that game is important or not. For example, if a team is 14-1, and already locked the division's top spot in the playoffs, then why risk injury? Thus they bench their star players early. This is bad for fantasy football teams. I'll explain why later.

What are skill areas and how does the scoring work?

Each week you face another owner. Each owner manages a team of fantasy football players. The number of players varies according to league rules.

For example, league ABC consists of 8 fantasy football players. The players are broken down like this: 1 Quarterback, 2 Running backs, 2 Wide Receivers, 1 Tight End, 1 Kicker, and 1 Team Defense = 8 players. These 8 players get points, and the sum of the points equals your team points. Whichever team in the head-to-head competition that has the higher point total wins for that week.

Scoring varies according to league rules as well. One simple example would be, 6 pts for each touchdown (passing, rushing, or receiving), 1 point for each 10 yards rushed or caught, etc.

Okay, so how do I get my team? Do I just get to pick players?

Sort of. Just like real football, there's usually a draft. However, there are also variations here, like a auction system draft. Most drafts, though, are typically setup as "rounds," where each round consists of each owner picking one pick. The order of this draft is pre-determined, and the position you have can greatly affect your team.

For example:

Round 1

1 pick: Owner A

2 pick: Owner B

3 pick: Owner C

4 pick: Owner D

5 pick: Owner E

6 pick: Owner F

7 pick: Owner G

8 pick: Owner H

Round 1

9 pick: Owner H

10 pick: Owner G

11 pick: Owner F

12 pick: Owner E

13 pick: Owner D

14 pick: Owner C

15 pick: Owner B

16 pick: Owner A

Notice how the draft order "snakes." This is a typical draft system.

So now you are ready to get started! Okay, maybe not, but hey I'm not done yet...so keep reading. First off, start by checking out a few of the "free" fantasy football sites, like Yahoo! Sports Fantasy. Just sign up and join up a random league. It's a great way to learn and meet people. Of course use Google!

Some sites to check out:

http://www.fftoday.com/

http://games.espn.go.com/ffl/frontpage

http://football.fantasysports.yahoo.com/f1

http://kffl.com/

http://www.profootballweekly.com/PFW/default.htm

My tips:

- Get a couple magazines. The Fantasy Football Index is a must for any fantasy football player. So get this at least. Buy it online to avoid sales tax and get free shipping. The second magazine is not a must have, but I like the Pro Forecast and Pro Football Weekly. Which one to get is your decision. I don't think it makes much sense to get more than 2 magazines though. Keep in mind by the 4th week in the regular season, most of information is outdated anyway. You'll be using it as a reference and for info on backup players and team schedules.

- Your draft strategy should be based upon:

- --Scoring system. This could change the value of a quarterback, running back, wide receiver, etc.

--Number of teams in your league. If you have a large league, than running backs become much more valuable! Keep in mind each team usually has one primary running back while there are two primary wide receivers.

--How many really good players are there in each skill area? If you have a dedicated Tight End position, then consider that there are only 3 or 4 really good tight ends. The rest are, well, blah. This makes those 3 or 4 players much more valuable. But don't overvalue them either! Nothing makes me giggle more than a tight end being taken in the 2nd or 3rd round of the draft.

--What's the drop off in quality between players? For example, the difference between quarterbacks are usually fairly small with a few exceptions like Peyton Manning in 2004-2005, but then the rest of the quarterbacks are all almost the same.

--Know you draft position! The first pick is great, but keep in mind that you have no more picks for quite awhile! "Bookends" or the last pick in the first round also has benefits since you get two picks in a row.

--Remember, you can always trade. If a valuable player is sitting there, but you don't need them, you may be able to score two players for that one, so it may be worthwhile to draft that player anyway. But don't lose site of the possibility that a trade may not work out.

--Think about the offense. A high scoring offense will add value to offensive players. Also, a running offense means runnings backs are good bets on that team. A passing offense means quarterbacks and wide receivers are good bets.

--Think about the team's schedule and division. A weak division is usually a good thing for a strong team, thus a good thing for fantasy players.

--Consider a player that was good the last last season, but flopped. They made be picked up later, but give you a high return.

Wednesday, July 05, 2006

Pretty Good Deal, Northwest Miles and National Rental Car. Double Upgrade & 150 Miles Per Day.

I just got an email from Northwest Airlines, and in it was a pretty decent offer. You get a free double upgrade from National Rental Car and an extra 150 miles per day. Click on the image to take you to the offer. The offer states good until December 31, 2006.

Here's the link.

Enjoy!

Click on the image to take you to the offer. The offer states good until December 31, 2006.

Here's the link.

Enjoy!

Click on the image to take you to the offer. The offer states good until December 31, 2006.

Here's the link.

Enjoy!

Click on the image to take you to the offer. The offer states good until December 31, 2006.

Here's the link.

Enjoy!

What If Our Cars Told Us How Much It Costs Per Mile?

What if our cars told us how much each mile costs us almost like a taxi cab meter? Would that make drivers more conscious about how much they are driving? Right now, our cars tell us how many miles we've traveled. The fancier cars tell us how many miles per gallon we're getting, but we don't necessarily associate the cost per mile unless we actually take the amount we spend on gas and divide that by the miles traveled. Even then, we don't see maintenance costs, insurance, etc. added to the picture.

What if, our car's console told us how much each trip costed? For example, if we knew:

Gas = $3.00 / gallon

Car's Fuel Efficieny = 20 mpg

Then cost per mile = $0.15/mile

If we took a 20 mile trip, that would be $3.00. Add in the return trip, and suddenly your little outing becomes a $6.00 venture. Would that make you think twice about driving?

Throw in maintenance and insurance costs, and suddenly cost per mile goes up. I personally would really love to see manufacturers start doing this. It would make everyone much more sensitive to how much they are driving. Of course car manufacturers would have to figure out some way of allowing drivers to input the cost to fill up each tank. Pretty simple fix to raise awareness I think.

What if our cars told us how much each mile costs us almost like a taxi cab meter? Would that make drivers more conscious about how much they are driving? Right now, our cars tell us how many miles we've traveled. The fancier cars tell us how many miles per gallon we're getting, but we don't necessarily associate the cost per mile unless we actually take the amount we spend on gas and divide that by the miles traveled. Even then, we don't see maintenance costs, insurance, etc. added to the picture.

What if, our car's console told us how much each trip costed? For example, if we knew:

Gas = $3.00 / gallon

Car's Fuel Efficieny = 20 mpg

Then cost per mile = $0.15/mile

If we took a 20 mile trip, that would be $3.00. Add in the return trip, and suddenly your little outing becomes a $6.00 venture. Would that make you think twice about driving?

Throw in maintenance and insurance costs, and suddenly cost per mile goes up. I personally would really love to see manufacturers start doing this. It would make everyone much more sensitive to how much they are driving. Of course car manufacturers would have to figure out some way of allowing drivers to input the cost to fill up each tank. Pretty simple fix to raise awareness I think.

How I Streeeeeetch Each Dollar I Spend, v2.0. Improved.

This is a revised version of my original post, which was, uhh, lacking. I'm critiquing and revising my own post. Sorry you had to click on that. This one is a little better, I think. As always, though, please comment.

Of course, my first priority is to try and save, but if I'm going to be spending money anyway, might as well try and stretch each dollar. Everyone has their own tricks on doing this. I'll share mine.

There are two categories, regular everyday items and "big ticket" items, over $100.00.

For everyday things:

1. Gas, grocery and drug store purchases should be done on a Citi Diamond Preferred Rewards card. You'll get 5% back as "ThankYou" points. One recent change I've noticed is that the 5% back in "ThankYou" points is only for the first year. Instead, you could use the Citi Dividend Platinum Select card and get 5% back cash, up to $300/year. I don't see the first year limitation on that card.

2. Eating out or buying office supplies? Then use the Citi Professional Card for 3% back in "ThankYou" points.

3. Get a "0% APR on purchases" card for everything else. Be sure to consider how much of a balance transfer you might put on this card, or you may not have enough credit to last the entire 0% period. Right now, I'm using an Amex Blue card that's got 0% on purchases until December. Or, you can choose to use a standard 1% back card as well. I'd say go with the 0% cards first though, I'm pretty sure you can do better than 1% over the remaining months of your 0% offer, that is unless you have just a few months left.

4. Tack on AA RewardsNetwork to your credit card! Especially good with the Citi Professional card. Dine program to Citi Professional Card for additional mileage bonus for eating at certain restaurants. You get miles, up to 10 miles per dollar and 3% back! Could equal almost 13% back.

5. Never use cash! Why? You get added benefits for using a card and on top of that they are lending you money for almost a whole month. Sure pennies in interest, but over a lifetime, it could be substantial.

6. And finally, try to buy generics or things on sale.

For "big ticket" items, over $100:

1. eBay is your best friend! Search eBay first...you can get a good idea of what price you should expect to pay. Be sure to look at "completed items." This way, you can see what people actually paid.

2. Search, search, search! Google becomes your second best friend. Search for the "Brand + model." For example, "Casio S600." You'll be presented with links to price comparison sites, which leads me to the next point.

3. Use pricewatch.com, pricegrabber.com, and nextag.com to compare prices. Electronics are the easiest things to compare, but almost anything can be compared.

4. Use slickdeals.net, flamingoworld.com, and fatwallet.com. These sites pack tons of great deals, like $30 off $100, 20% codes, etc. Be sure to add their RSS feeds to your reader.

5. Buy with an online merchant that does not charge sales tax! Could be a large savings depending on how much you are spending. Generally, if you see a brick & mortar version of the online merchant in your area, you'll pay sales tax.

6. WAIT. If at all possible. When a deal appears, jump on it. Besides, waiting might make you reconsider your purchase. Do you really need it?

Also, if you're interested in free stuff, then check out this site, AbsurdlyCool.com. They only post free things! Pretty cool...actually absurdly cool!

Now if only I could use one credit card to pay off another...I'd be getting everything for free (and making some money)! I haven't got into newspaper coupons, yet, but maybe that's next. How about you? Any additional tips on stretching each dollar?

This is a revised version of my original post, which was, uhh, lacking. I'm critiquing and revising my own post. Sorry you had to click on that. This one is a little better, I think. As always, though, please comment.

Of course, my first priority is to try and save, but if I'm going to be spending money anyway, might as well try and stretch each dollar. Everyone has their own tricks on doing this. I'll share mine.

There are two categories, regular everyday items and "big ticket" items, over $100.00.

For everyday things:

1. Gas, grocery and drug store purchases should be done on a Citi Diamond Preferred Rewards card. You'll get 5% back as "ThankYou" points. One recent change I've noticed is that the 5% back in "ThankYou" points is only for the first year. Instead, you could use the Citi Dividend Platinum Select card and get 5% back cash, up to $300/year. I don't see the first year limitation on that card.

2. Eating out or buying office supplies? Then use the Citi Professional Card for 3% back in "ThankYou" points.

3. Get a "0% APR on purchases" card for everything else. Be sure to consider how much of a balance transfer you might put on this card, or you may not have enough credit to last the entire 0% period. Right now, I'm using an Amex Blue card that's got 0% on purchases until December. Or, you can choose to use a standard 1% back card as well. I'd say go with the 0% cards first though, I'm pretty sure you can do better than 1% over the remaining months of your 0% offer, that is unless you have just a few months left.

4. Tack on AA RewardsNetwork to your credit card! Especially good with the Citi Professional card. Dine program to Citi Professional Card for additional mileage bonus for eating at certain restaurants. You get miles, up to 10 miles per dollar and 3% back! Could equal almost 13% back.

5. Never use cash! Why? You get added benefits for using a card and on top of that they are lending you money for almost a whole month. Sure pennies in interest, but over a lifetime, it could be substantial.

6. And finally, try to buy generics or things on sale.

For "big ticket" items, over $100:

1. eBay is your best friend! Search eBay first...you can get a good idea of what price you should expect to pay. Be sure to look at "completed items." This way, you can see what people actually paid.

2. Search, search, search! Google becomes your second best friend. Search for the "Brand + model." For example, "Casio S600." You'll be presented with links to price comparison sites, which leads me to the next point.

3. Use pricewatch.com, pricegrabber.com, and nextag.com to compare prices. Electronics are the easiest things to compare, but almost anything can be compared.

4. Use slickdeals.net, flamingoworld.com, and fatwallet.com. These sites pack tons of great deals, like $30 off $100, 20% codes, etc. Be sure to add their RSS feeds to your reader.

5. Buy with an online merchant that does not charge sales tax! Could be a large savings depending on how much you are spending. Generally, if you see a brick & mortar version of the online merchant in your area, you'll pay sales tax.

6. WAIT. If at all possible. When a deal appears, jump on it. Besides, waiting might make you reconsider your purchase. Do you really need it?

Also, if you're interested in free stuff, then check out this site, AbsurdlyCool.com. They only post free things! Pretty cool...actually absurdly cool!

Now if only I could use one credit card to pay off another...I'd be getting everything for free (and making some money)! I haven't got into newspaper coupons, yet, but maybe that's next. How about you? Any additional tips on stretching each dollar?

The Orange (ING) That Started It All Is Going Bad

They pratically revolutionized the online savings frenzy, but now they seemed to have lost focus. The high rates were key to their success, and suddenly with all the competition, they've just seem to have accepted taking last place.

I'm pretty dissappointed by ING's recent decisions to lag behind in the rates war. I like the ING site, it's clean and easy to use. But if they can't keep up, then I might have to consider moving almost all of my funds out. The Orange is going bad.

There is hope though. If ING doesn't want to play the rates game, then I think they could offer features. Features, like their "Orange Checkings," that they sent out surveys about 1 year ago, would be a good one. I don't think features are as effective as basic rates, but it could be enough. But still, for me, rates were the biggest draw to ING. We shall see. It seems the online banking business is going through a major stage of evolution. I'm guessing that largely due to the explosion in financial institutions offering "online" accounts. Competition is great isn't it?!

They pratically revolutionized the online savings frenzy, but now they seemed to have lost focus. The high rates were key to their success, and suddenly with all the competition, they've just seem to have accepted taking last place.

I'm pretty dissappointed by ING's recent decisions to lag behind in the rates war. I like the ING site, it's clean and easy to use. But if they can't keep up, then I might have to consider moving almost all of my funds out. The Orange is going bad.

There is hope though. If ING doesn't want to play the rates game, then I think they could offer features. Features, like their "Orange Checkings," that they sent out surveys about 1 year ago, would be a good one. I don't think features are as effective as basic rates, but it could be enough. But still, for me, rates were the biggest draw to ING. We shall see. It seems the online banking business is going through a major stage of evolution. I'm guessing that largely due to the explosion in financial institutions offering "online" accounts. Competition is great isn't it?!

Tuesday, July 04, 2006

Gates & Buffett's Admirable Mission and The Pursuit of Happiness. Happy 230th Birthday America!

I figured this would be an appropriate post for the 4th of July, since the holiday celebrates the independence of this great nation, which provides its citizens with so many opportunities.

"We hold these Truths to be self-evident, that all Men are created equal, that they are endowed, by their Creator, with certain unalienable Rights, that among these are Life, Liberty, and the Pursuit of Happiness." - Declaration of Independence, United States of America, July 4, 1776.

"...the Pursuit of Happiness." What is does it mean? To each person, it has a different definition. For me, happiness is rooted in what my dad keeps telling me over and over and over, "Work hard and make lots of money so you can give back. That's how you'll be happy." I think I agree.

First Gates announces his slow retirment from Microsoft. Then Buffett pledges a tiny sum of nearly 30 billion to the Gates Foundation. Kudos to Gates & Buffett! Seriously. Even if they had some ulterior motives, I don't care.

There is no reason we can’t cure the top 20 diseases.I believe it, and even if 5 out of the 20 were cured, that'd be amazing. I'm very curious how the next few years turn out, and I really, really hope I'll be reading more about the Gates Foundation in the years to come. Then I read Buffett talking about why he wants to give to the Gates Foundation and not keep the wealth in the family, he says,