Change vs. previous month: $8,835.73 (4.99%)

% 2006 Goal Complete: 29.4%

% 2030 Goal Complete: 7.4%

Some points of interest for this month's net worth update:

- Recent Chase 0% offer. This won't affect my final net worth, but $$$ were shifted around.

- Bonus received in March.

- My big car loan payment hasn't been made yet, mainly because the process of doing the balance transfer has taken about a month. I plan to get that done in April. I also plan to do my major asset re-allocation in April.

- I didn't have any major expenses in March.

Upcoming expenses:

- Taxes! Yuck. (~$2000, Federal and State).

- I maybe making an electronics purchase (~$500).

- Airline tickets for a wedding.

If I'm able to maintain an average growth of $8,000 per month, I'll be able to meet my 2006 goal. I'll definitely need to start considering what stocks, funds, bonds to invest in with my upcoming asset re-allocation.

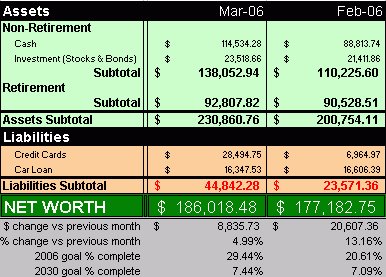

Change vs. previous month: $8,835.73 (4.99%)

% 2006 Goal Complete: 29.4%

% 2030 Goal Complete: 7.4%

Some points of interest for this month's net worth update:

- Recent Chase 0% offer. This won't affect my final net worth, but $$$ were shifted around.

- Bonus received in March.

- My big car loan payment hasn't been made yet, mainly because the process of doing the balance transfer has taken about a month. I plan to get that done in April. I also plan to do my major asset re-allocation in April.

- I didn't have any major expenses in March.

Upcoming expenses:

- Taxes! Yuck. (~$2000, Federal and State).

- I maybe making an electronics purchase (~$500).

- Airline tickets for a wedding.

If I'm able to maintain an average growth of $8,000 per month, I'll be able to meet my 2006 goal. I'll definitely need to start considering what stocks, funds, bonds to invest in with my upcoming asset re-allocation.

Friday, March 31, 2006

03.2006 Net Worth [+$8,835.73]

Do any of you look forward to figuring your monthly net worth numbers? I really can't wait to go through and put everything into my spreadsheet and see how things come out. I used to do it randomly, but that makes it a little harder to see how your improving since fluctuations can vary.

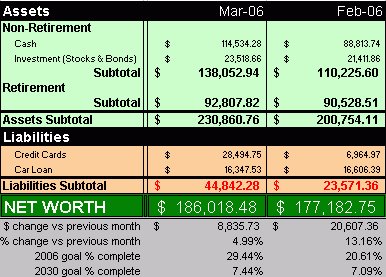

So here's my net worth for March 2006:

Change vs. previous month: $8,835.73 (4.99%)

% 2006 Goal Complete: 29.4%

% 2030 Goal Complete: 7.4%

Some points of interest for this month's net worth update:

- Recent Chase 0% offer. This won't affect my final net worth, but $$$ were shifted around.

- Bonus received in March.

- My big car loan payment hasn't been made yet, mainly because the process of doing the balance transfer has taken about a month. I plan to get that done in April. I also plan to do my major asset re-allocation in April.

- I didn't have any major expenses in March.

Upcoming expenses:

- Taxes! Yuck. (~$2000, Federal and State).

- I maybe making an electronics purchase (~$500).

- Airline tickets for a wedding.

If I'm able to maintain an average growth of $8,000 per month, I'll be able to meet my 2006 goal. I'll definitely need to start considering what stocks, funds, bonds to invest in with my upcoming asset re-allocation.

Change vs. previous month: $8,835.73 (4.99%)

% 2006 Goal Complete: 29.4%

% 2030 Goal Complete: 7.4%

Some points of interest for this month's net worth update:

- Recent Chase 0% offer. This won't affect my final net worth, but $$$ were shifted around.

- Bonus received in March.

- My big car loan payment hasn't been made yet, mainly because the process of doing the balance transfer has taken about a month. I plan to get that done in April. I also plan to do my major asset re-allocation in April.

- I didn't have any major expenses in March.

Upcoming expenses:

- Taxes! Yuck. (~$2000, Federal and State).

- I maybe making an electronics purchase (~$500).

- Airline tickets for a wedding.

If I'm able to maintain an average growth of $8,000 per month, I'll be able to meet my 2006 goal. I'll definitely need to start considering what stocks, funds, bonds to invest in with my upcoming asset re-allocation.

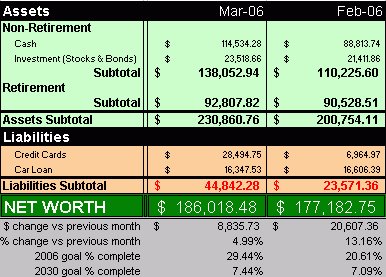

Change vs. previous month: $8,835.73 (4.99%)

% 2006 Goal Complete: 29.4%

% 2030 Goal Complete: 7.4%

Some points of interest for this month's net worth update:

- Recent Chase 0% offer. This won't affect my final net worth, but $$$ were shifted around.

- Bonus received in March.

- My big car loan payment hasn't been made yet, mainly because the process of doing the balance transfer has taken about a month. I plan to get that done in April. I also plan to do my major asset re-allocation in April.

- I didn't have any major expenses in March.

Upcoming expenses:

- Taxes! Yuck. (~$2000, Federal and State).

- I maybe making an electronics purchase (~$500).

- Airline tickets for a wedding.

If I'm able to maintain an average growth of $8,000 per month, I'll be able to meet my 2006 goal. I'll definitely need to start considering what stocks, funds, bonds to invest in with my upcoming asset re-allocation.

Change vs. previous month: $8,835.73 (4.99%)

% 2006 Goal Complete: 29.4%

% 2030 Goal Complete: 7.4%

Some points of interest for this month's net worth update:

- Recent Chase 0% offer. This won't affect my final net worth, but $$$ were shifted around.

- Bonus received in March.

- My big car loan payment hasn't been made yet, mainly because the process of doing the balance transfer has taken about a month. I plan to get that done in April. I also plan to do my major asset re-allocation in April.

- I didn't have any major expenses in March.

Upcoming expenses:

- Taxes! Yuck. (~$2000, Federal and State).

- I maybe making an electronics purchase (~$500).

- Airline tickets for a wedding.

If I'm able to maintain an average growth of $8,000 per month, I'll be able to meet my 2006 goal. I'll definitely need to start considering what stocks, funds, bonds to invest in with my upcoming asset re-allocation.

Daylight Savings: Spring Forward on Monday!

Don't forget to move those hours hands ahead by one hour on Sunday night! At 2am, time magically jumps ahead one hour. Losing one hour of sleep sucks.

Friday! Update: Doggie. Details. 03.31.2006

Hmmm, well the smoking updates are getting a little old, but yeah, I still haven't gone back. I'm way past the 21 days mark that SingleMa said would be the official point of having broke the habit...so I'm past it! Woohoo!

I also updated my doggie costs due to some recent food purchases. Which reminds me...Neo has a new blog dedicated to his dog, check it out!

I can't wait to work on my net worth for this month.

I haven't had as much time as I would have liked to read other blogs, but I did find one post that contained a lot of financial details...it's impressive. Thanks Brian and nice work.

Have a great weekend everyone!

My Top 5 Financial Touchdowns

So I wrote awhile back on what I thought were my top 5 financial blunders. Well, it's only fair that I look at what I think were my top 5 financial touchdowns. It was really, really hard to describe 5 specific financial moves.

These are not listed in a particular order. It was hard enough trying to remember them, and then getting enough details to make them substantial enough to write about. In fact I'm still not sure about that...but hey, it's a start...

- Blogging.

Blogging has helped me focus on the details of my net worth. Tracking net worth itself is great, but without some way to really look at the numbers and wonder why things are the way, you only know the very surface of things. Blogging also has helped gain insight I never would have stumbled across by trying to learn on my own. Read more here.

- Tracking net worth.

It all started with using my former credit union site which had access to Yodlee's My Worth service. It tracked my net worth automatically. Knowing my net worth really makes me consider things like whether my next purchase is "worth it," or why is my net worth not increasing as much as it should? Without an understanding of where you are at the moment, it becomes very difficult to identify where you are headed.

- Getting a job during high school.

Getting a job as soon as I can probably gave me a real sense of what it is to earn money. Of course chores had the same effect, actually getting a paycheck, being able to plan and figure out what to do with the money I earned helped me become more responsible. I think.

- Getting credit cards from a young age.

I have a long credit history...goes back almost 10 years. Not to mention, credit cards taught me to really hate debt. I could see credit cards easily turning into one of my top 5 mistakes as well though.

- College: Attending my state public university rather than a private university.

Probably the single most important decision I made. I attended private school from K - 12, thanks mom and dad, but when it came to college, I decided to go to my local state university. Which choice would you have made?

College - A Financial Decision That Changed My Life.

In my senior year of high school, I was faced with one of the single, most important decisions of my life, where to go to college--a local state university plus full scholarship or ivy league university with no financial aid. No matter how much I tried to contemplate what would have happened if I made the other decision, I'll never know for sure.

The ivy league university offered me no financial assistance, but it did give me the chance to gain an education that would be on par with the top universities in the nation, it would have given me a chance to network with many individuals and alumni that would become or are top executives, and it would have given me a chance to live in an exciting city that never sleeps, but on the other hand it would have put a huge financial strain on myself and my family. My other choice was my local state university that offered me a scholarship and gave me cash, $18k + tuition, and I wouldn't have to pay for room and board since I could live at home and commute. I believe it may have been in the top 250 universities of this country at the time, but it was no ivy.

I made the decision to attend my local state university. However, I did take advantage of my universities exchange program that allowed me to go to another public university paying my current tuition, which is a huge discount. I also landed an excellent job after graduating, which I still have today. Even with all that, I still wonder, what would have been if I chose differently. What would be my net worth today had I gone the ivy path? Some of my friends that I talk to today, still tell me I should have gone to the ivy. Did I make the better choice? I guess I'll never know.

I do know that I can't complain about the position I'm in today, so I'll just leave it at that for now...maybe one day I can attend grad school at the ivy and bring closure to one of those "what if" questions...ahhh...Do you have any of those? What would you have done in my situation? I guess life isn't worth thinking about things I can't change anyway...it's Friday...what to do this weekend :).

In my senior year of high school, I was faced with one of the single, most important decisions of my life, where to go to college--a local state university plus full scholarship or ivy league university with no financial aid. No matter how much I tried to contemplate what would have happened if I made the other decision, I'll never know for sure.

The ivy league university offered me no financial assistance, but it did give me the chance to gain an education that would be on par with the top universities in the nation, it would have given me a chance to network with many individuals and alumni that would become or are top executives, and it would have given me a chance to live in an exciting city that never sleeps, but on the other hand it would have put a huge financial strain on myself and my family. My other choice was my local state university that offered me a scholarship and gave me cash, $18k + tuition, and I wouldn't have to pay for room and board since I could live at home and commute. I believe it may have been in the top 250 universities of this country at the time, but it was no ivy.

I made the decision to attend my local state university. However, I did take advantage of my universities exchange program that allowed me to go to another public university paying my current tuition, which is a huge discount. I also landed an excellent job after graduating, which I still have today. Even with all that, I still wonder, what would have been if I chose differently. What would be my net worth today had I gone the ivy path? Some of my friends that I talk to today, still tell me I should have gone to the ivy. Did I make the better choice? I guess I'll never know.

I do know that I can't complain about the position I'm in today, so I'll just leave it at that for now...maybe one day I can attend grad school at the ivy and bring closure to one of those "what if" questions...ahhh...Do you have any of those? What would you have done in my situation? I guess life isn't worth thinking about things I can't change anyway...it's Friday...what to do this weekend :).

Thursday, March 30, 2006

Why Do You Blog? Fame? Money? Health?

PFBlog's blog recently wrote up an article: Some Sanity is Needed, Upcoming Contest, and it brought up some interesting thoughts/feelings and a chance for me to reflect on my reasons for blogging.

I guess you could categorize me as a longtime Internet user, but not a long time blogger...I'm a lurker. Since the early days of bulletin boards and dial up, I've been lurking and searching for the end of the Internet. I've never been one to fear buying things online, actually I doubt a majority of the folks blogging and reading finance blogs are even though I did see a recent survey that indicated the majority of the population still has some hesitation of online commerce. Sorry, went off on a tangent...So anyway, I really wanted to find an answer to this question, "At my age, how am I doing financially?" Better? Worse? Average? One site my searching led me to was bestcashcow.com. But I kept searching...keywords: "my net worth," which led me to freemoneyfinance.com. And thus, my interest of blogging began...

I never knew a world of personal net worth tables and Moneysmartz' bnwi existed! Holy crap, abc is worth how much?!?! How the hell does xyz have that much debt?!?! Hmmm, how am I doing? I found myself itching for the next net worth update of people I didn't even know.

Eventually I realized I should be contributing too. So I started blogging...because I had lots of quirks related to money that I did for myself, why not write it down...Maybe other people could gain from it? And to be honest, for the longest time I yearned an avenue where I could write about money--my money, to be criticized by others and to find areas where I could improve. And blogging sure has helped me...from deciding to pay down my debt, to quitting the cancer sticks, to looking at my asset allocations, to seeing if my exuberance for a national sales tax had some merit, to figuring out what was really going in and out of my bank accounts...and why. Blogging really helps me manage my finances better, and thus I blog. At the same time, if it helps someone else, then it becomes that much better. So why do you blog?

EDIT: I should add, it definitely is nice to have readers though...Can't lie about that :), and I appreciate it.

EDIT EDIT: I really had to take that line out because it bothered me.

I guess you could categorize me as a longtime Internet user, but not a long time blogger...I'm a lurker. Since the early days of bulletin boards and dial up, I've been lurking and searching for the end of the Internet. I've never been one to fear buying things online, actually I doubt a majority of the folks blogging and reading finance blogs are even though I did see a recent survey that indicated the majority of the population still has some hesitation of online commerce. Sorry, went off on a tangent...So anyway, I really wanted to find an answer to this question, "At my age, how am I doing financially?" Better? Worse? Average? One site my searching led me to was bestcashcow.com. But I kept searching...keywords: "my net worth," which led me to freemoneyfinance.com. And thus, my interest of blogging began...

I never knew a world of personal net worth tables and Moneysmartz' bnwi existed! Holy crap, abc is worth how much?!?! How the hell does xyz have that much debt?!?! Hmmm, how am I doing? I found myself itching for the next net worth update of people I didn't even know.

Eventually I realized I should be contributing too. So I started blogging...because I had lots of quirks related to money that I did for myself, why not write it down...Maybe other people could gain from it? And to be honest, for the longest time I yearned an avenue where I could write about money--my money, to be criticized by others and to find areas where I could improve. And blogging sure has helped me...from deciding to pay down my debt, to quitting the cancer sticks, to looking at my asset allocations, to seeing if my exuberance for a national sales tax had some merit, to figuring out what was really going in and out of my bank accounts...and why. Blogging really helps me manage my finances better, and thus I blog. At the same time, if it helps someone else, then it becomes that much better. So why do you blog?

EDIT: I should add, it definitely is nice to have readers though...Can't lie about that :), and I appreciate it.

EDIT EDIT: I really had to take that line out because it bothered me.

I guess you could categorize me as a longtime Internet user, but not a long time blogger...I'm a lurker. Since the early days of bulletin boards and dial up, I've been lurking and searching for the end of the Internet. I've never been one to fear buying things online, actually I doubt a majority of the folks blogging and reading finance blogs are even though I did see a recent survey that indicated the majority of the population still has some hesitation of online commerce. Sorry, went off on a tangent...So anyway, I really wanted to find an answer to this question, "At my age, how am I doing financially?" Better? Worse? Average? One site my searching led me to was bestcashcow.com. But I kept searching...keywords: "my net worth," which led me to freemoneyfinance.com. And thus, my interest of blogging began...

I never knew a world of personal net worth tables and Moneysmartz' bnwi existed! Holy crap, abc is worth how much?!?! How the hell does xyz have that much debt?!?! Hmmm, how am I doing? I found myself itching for the next net worth update of people I didn't even know.

Eventually I realized I should be contributing too. So I started blogging...because I had lots of quirks related to money that I did for myself, why not write it down...Maybe other people could gain from it? And to be honest, for the longest time I yearned an avenue where I could write about money--my money, to be criticized by others and to find areas where I could improve. And blogging sure has helped me...from deciding to pay down my debt, to quitting the cancer sticks, to looking at my asset allocations, to seeing if my exuberance for a national sales tax had some merit, to figuring out what was really going in and out of my bank accounts...and why. Blogging really helps me manage my finances better, and thus I blog. At the same time, if it helps someone else, then it becomes that much better. So why do you blog?

EDIT: I should add, it definitely is nice to have readers though...Can't lie about that :), and I appreciate it.

EDIT EDIT: I really had to take that line out because it bothered me.

I guess you could categorize me as a longtime Internet user, but not a long time blogger...I'm a lurker. Since the early days of bulletin boards and dial up, I've been lurking and searching for the end of the Internet. I've never been one to fear buying things online, actually I doubt a majority of the folks blogging and reading finance blogs are even though I did see a recent survey that indicated the majority of the population still has some hesitation of online commerce. Sorry, went off on a tangent...So anyway, I really wanted to find an answer to this question, "At my age, how am I doing financially?" Better? Worse? Average? One site my searching led me to was bestcashcow.com. But I kept searching...keywords: "my net worth," which led me to freemoneyfinance.com. And thus, my interest of blogging began...

I never knew a world of personal net worth tables and Moneysmartz' bnwi existed! Holy crap, abc is worth how much?!?! How the hell does xyz have that much debt?!?! Hmmm, how am I doing? I found myself itching for the next net worth update of people I didn't even know.

Eventually I realized I should be contributing too. So I started blogging...because I had lots of quirks related to money that I did for myself, why not write it down...Maybe other people could gain from it? And to be honest, for the longest time I yearned an avenue where I could write about money--my money, to be criticized by others and to find areas where I could improve. And blogging sure has helped me...from deciding to pay down my debt, to quitting the cancer sticks, to looking at my asset allocations, to seeing if my exuberance for a national sales tax had some merit, to figuring out what was really going in and out of my bank accounts...and why. Blogging really helps me manage my finances better, and thus I blog. At the same time, if it helps someone else, then it becomes that much better. So why do you blog?

EDIT: I should add, it definitely is nice to have readers though...Can't lie about that :), and I appreciate it.

EDIT EDIT: I really had to take that line out because it bothered me.

Tuesday, March 28, 2006

My 2005 Taxes. Done.

Well, I finished my taxes a couple days ago. I have to make payments in April...Well, I guess that means a temporary dip in the net worth chart.

Here are the tax percentages I paid in 2005:

Federal: 17.3%

State: 6.7%

Dang, I wish I could my tax rate under 10%...I need to have kids or go to school!

I've been feeling a little under the weather as of late, so I'm not sure how much blogging I'll do. Thanks for reading!

Monday, March 27, 2006

National Sales Tax: A Closer Look At $$$ Figures...Part 3

Continuing on part 2...

Imagine no income tax, no more waiting for W2s and trying to figure out how many allowable exemptions to take this year, no more giving the government an interest free loan, and imagine saving tax free...That's what started this series, but now it's time for a deeper look.

What would be a reasonable "tax rate"? I'm thinking about 10-20% would be a ballpark figure of what I would expect to pay. I did some digging to try and find out, what if we really switched to a national sales tax? Well, I found some info at www.taxpolicycenter.org that listed Total US Income tax collected in 2003.

Total US Income Tax (2003): $1,683,184,679,000 (reference)

Then I needed to find some data on how much sales is done in the US that would be subject to the national sales tax. So I looked up retail sales information for 2003. On a side note, in my search I noticed everyone talks about percent increases in consumer spending, but no $$$ figure to go with it! But I finally found some data at census.gov.

Total US Retail Sales (2003, not seasonally adjusted, reference): $3,275,407,000,000.

Wait, wait, wait...If you noticed and said, "OMG, I have to pay 50% tax??!?!" Hold on for a sec. Be sure you consider the whole picture...

1. You no longer have federal income tax being witheld from your paychecks! That's a big boost each pay period.

2. Tax credits would still be given depending on your exemptions.

3. Retail sales data above might not be complete.

4. Government can always get more budget conscious. (ha!)

So if the US Census Retail Sales data is accurate, then $3.3 trillion would be taxed, which would mean a fifty percent tax! Could you imagine?? Is it worth it? I don't know. It would definitely get me spending less and saving more.

Some odditities I found while searching for total US Retail Sales data...This other site reported annual retail sales in 2003 in the US of $59 trillion! That's a huge difference compared to the $3.2 trillion reported by the census. Although, $59 trillion sounds a little un-realistic. That would mean a national sales tax rate of 3%. :) So what's the real number? Beats me! But it would make a huge difference in whether people would support a drastic change like national sales tax.

Another issue, what would happen to retirement accounts? Tax free would certainly lose its appeal.

When I first started this series on national sales tax, I was all for it. After seeing the possible $$$ figures, I still am. It would get tourists, tax evaders, and immigrants all contributing to the country they are visiting or living in, and that sounds fair to me. I do have some concerns, but when you look at the concept in its fundamental state, it makes sense. This is the reason I believe it would work...Not to mention all the lost productivity due to hours of brain mangling tax work can now be spent freely. How do you put a monetary value on that?

Friday, March 24, 2006

New Retirement Planning Idea! The 401K-Keg Plan.

If you haven't heard about this plan, you should read about it. Found this in a forum I read, on the topic of financials and retirement...quite educational and definitely something to think about ;)

If you had purchased $1000.00 of Nortel stock one year go, it would now be worth $49.00. With Enron, you would have had $16.50 left of the original $1,000.00. With WorldCom, you would have had less than $5.00 left. But, if you had purchased $1,000.00 worth of beer one year ago, drank all the beer, then turned in the cans for the aluminum recycling REFUND,you would have had $214.00. Based on the above, the best current investment advice is to drink heavily and recycle. It's called the 401-Keg Plan.I'm not sure how accurate the numbers are, but oh well that's not the point! And that's why I have my disclaimer at the bottom on this page. LOL. Have an awesome weekend!

Northwest (NWA) Miles...1000 miles and more!

If you're interested, signup for the NWA newsletter and get 1000 miles. You have to remain on the list for a couple months...there's some other restrictions, so read the fine print.

And if you know a friend who's going to take a trip, refer them and get miles! Refer them to just check in online and you get free miles.

What's with Northwest giving away free miles recently?

Friday! Update: Smoking, Frugality, and Metrosexuality...03.24.2006

Thanks to Singlemom and Eric for their support...I'm proud to say that I'm still smoke free! It's now been almost a month! 20 days of being smoke free...saving me a whopping $45.00! Not too shabby.

This week has been kind of busy for me at work. On top of that it's just been rainy and dreary, so I haven't really been as motivated as I wish I was...My blogging has been meh.

I did find a couple posts that were quite fascinating...The first from Kirby, with a post on being so frugal, we some times forget the value of time in our search for the cheapest things.

And the other from Make Love, Not Debt, who talks about getting $35.00 haircuts! I'd say that's not being overly frugal. :) But definitely not for me...I'm happy with finding the best deal on haircuts...But I'm not quite ready to go bald. Yet.

Have a great weekend everyone!

National Sales Tax. Part 2

Thanks for all the comments to my original post.

I knew when I wrote the post that there are tons of fine details that need to be taken into consideration, but the bottom line in my opinion is that a national sales tax in replacement of our current income tax would be pretty awesome. Of course fine tuning would be required.

PROs

- Encourage savings.

- Simple, reduce time required, improve producitivity (because people will do other things).

- Reduce government costs, save taxpayer money!

- Tax everyone, including tourism and non-citizens. Non-citizens (aka illegal immigrants) should pay taxes. I believe Tourists should as well, especially since they are using our resources while visiting.

Important Considerations

- Rebate system. There would should be some sort of "rebate" system, which would allow credit for certain income brackets, and other credits.

- What would the "tax rate" be?

- Is everything taxable?

- Is everything taxable at the same rate?

- Industries would virtually be eliminated...Block heads no more...IRS minimized...what type of actions would be done to help evolve these industries? Real lives will be affected.

It seems like the one prevalent belief is that this would not happen anytime soon. It would really be well worth a national discussion on this. Maybe we (pf bloggers and readers) could make it happen? Now THAT would be something to blog. :)

Thursday, March 23, 2006

Let's Get Rid Of "Income Tax"! National Sales Tax Just A Dream?

I hate doing taxes. Imagine if we all didn't have to "do taxes"! Am I living in a dream world? Of course not paying taxes is definitely dreaming, but is not having to fill out tiny boxes or guessing how much I'm going to owe the government next year a possibility or just a crazy idea? What's that addage? Something like "There are 2 things guaranteed in life...taxes and death." So getting rid of taxes completely is not an option, but a national sales tax?

Maybe not so crazy if you look at some "almost radical" ideas being brought up by our politicians. One of them I really like, and it's the idea of a national sales tax. Instead of being taken out of wages, taxes would be taken out of everything we buy. Read more about it here. The "flat-tax system" is another idea out there, but I'm not so sure I agree with that.

I hope this is an issue that becomes more prominent in the future. I think the US tax system is really a waste of time and energy, and should be made much simpler. It would definitely encourage saving! And of course change is always scary, but in many cases well worth it. What do you think? This is US specific...but there must be some countries with better systems? I have to do some research...

Wednesday, March 22, 2006

Earn 250 AAdvantage Miles (American Airlines)

Just visit this site and register! You have to watch the intro, but it's just a minute or so. You can also earn more miles if you test drive or buy a Lincoln Zephyr.

A note on this offer...I actually forgot about it, and today I received an email to signup. I should give credit to Slickdeals.net though, because they did have it there about a month ago...where I initially saw it. I didn't start my blog yet though! Here's a direct link to the form...so you can bypass the intro.

FDIC Insurance Limit To Go Up...Sort Of.

The FDIC insurance limit is going up to $250,000 on April 1, 2006...on retirement accounts at financial institutions with FDIC coverage.

Regular insurance limit stays at $100,000.

The best article I could find on the limit increase, was at the Dallas Morning News.

One point that I was always confused with in regards to the insurance coverage was what if you had more than $100,000 but spread out across different banks? Well according to the FDIC website:

Basic Insurance Limit Is $100,000 The FDIC insures deposit accounts such as checking, NOW and savings accounts, money market deposit accounts, and certificates of deposit (CDs). The basic insurance limit is $100,000 per depositor per insured bank.Then another section says:

Coverage Over $100,000 If you or your family has deposits at one insured bank totaling more than $100,000, you should know that different ownership categories of accounts are separately insured up to $100,000. You may qualify for more than $100,000 in coverage at one insured bank if you own deposit accounts in different ownership categories.My interpretation is that if you spread your money across different banks, you are entitled to $100,000 in coverage per bank. So I called...1-877-ASK-FDIC (1-877-275-3342). She confirmed, you are covered separately for each bank. Great news! Don't keep over $100,000 in one bank, unless you have varying account types like joint and single owner. Read more at the FDIC site.

What's In My Wallet?

Brand:

Kaiser.

Type:

Bi-fold, black leather.

Contents:

- Driver's license

- Lucky charm (I'm not superstitious)

- Lucky charm 2 (Really! People gave these to me...)

- Secret Santa paper (Wow! time to clean the wallet out)

- 3 $20s

- 2 $5s

- 5 $1s (I usually have a max of $20 cash lol)

- David & Buster's Power Card (Why do I have this in here? I haven't gone for over a year)

- City & County Golf Card

- Work badge

- Costco card

- American Express Corporate Card

- Visa Business Card

- Best Buy gift card

- Medical card

- Home Depot gift card

- Starbucks gift card

- ATM Card

- ATM Card 2

- Mastercard

- Mastercard 2

- American Express Blue card

- Entertainment card

- Doggie appointment reminder card

- $1 off Quiznos coupon

- Laminated card with phone numbers, membership numbers

- Various frequent customer cards

- 3 receipts (ATM withdrawls, food, etc.)

WOW! I have a ton of stuff in my wallet...What's in yours?

Tuesday, March 21, 2006

Even In the 21st Century, Class Matters...

I don't know how to start this. On one hand, I want to go on and on about how I wish the world were blind to gender, age, race, sexual orientation, and on the other I know that no matter how hard we try, it's an endless war. I hope one day it's gone completely.

I remember learning in high school about social class, which included a bit on French social class and Bourgeoisie...Might have been in World History class...ahh, I don't remember. I always thought that was a neat word...Sounds funny when you say it. Along with onomatopoeia...Haha. See I did pay attention in high school. Sometimes...

Well, even today, hundreds of years later, class still matters. John @ The Financial Ladder brings up this section at the NY Times that discusses social class. Within this section, there's one chart that really peaks my interest, under the tab "Nationwide Poll," then "Opportunity and Advancement." Over 75% of respondents said that the likelihood of moving up is the same or greater than it was 30 years ago. That's pretty cool. At least some dreams still exist in America. Now to figure out why the other 25% feels different...

Monday, March 20, 2006

Monthly Poll: 2006 Better or Worse? Closing early.

I've decided to close the poll early. Blogpoll.com was slow, had some,uhhh, in-appropriate ads after you voted (I did not pick those!), and the overwhelming vote (84%) indicates 2006 being better than 2005. For those that indicated better, I hope that's the case for the entire year!

There were 3 votes (12%) indicating that this year is worse than 2005, though. Whatever the reasons for that, I do hope it gets better. We're only 25% through the year, which leaves a lot of time for improvement.

Finally, 1 vote (4%) indicated the same...I hope the same means that you are making your millions! :) Thanks for all the votes everyone.

I've decided to close the poll early. Blogpoll.com was slow, had some,uhhh, in-appropriate ads after you voted (I did not pick those!), and the overwhelming vote (84%) indicates 2006 being better than 2005. For those that indicated better, I hope that's the case for the entire year!

There were 3 votes (12%) indicating that this year is worse than 2005, though. Whatever the reasons for that, I do hope it gets better. We're only 25% through the year, which leaves a lot of time for improvement.

Finally, 1 vote (4%) indicated the same...I hope the same means that you are making your millions! :) Thanks for all the votes everyone.

To All Animal Lovers...Poor Mooie.

This is a call to all animal lovers, and even those that have allergies and can't stand them...I just found a website about an animal that was tortured and abused that touched my heart.

Mooie is a 4 month old puppy that was burned by acid over 80% of her body. Just a couple months younger than my dog :(. The police and animal authorities involved did nothing to investigate the issue and destroyed crucial evidence. They don't know who did it.

I just want to spread the word so that the public is more aware that this type of activity occurs and probably falls under the radar more often than might be thought because animals can't speak out for themselves. If you know anyone that is abusing an animal, call your local humane society. I hope that this is just an exception, and most animal cruelty cases will be handled properly.

***WARNING*** Graphic content on link. ***WARNING***

Justice for Mooie

***WARNING*** Graphic content on link. ***WARNING***

Know Your Credit Card Benefits!

Price matching, extended warranty, loss/theft reimbursement...it's easy to forget many credit cards offer this whenever you use their cards. I just thought I'd share some information I used in the past...

Here are links to the benefits I could find offer for each type of card:

Different levels of cards offered have names like Platinum, Gold, Bronze, Titanium, Signature, Blue, and Green -- each with different features and services.

Some sites like visa.com lets you actually store product information, which is really convenient, because you don't have to worry about it should something happen to your purchase.

The general benefits vary, but the core and best offerings are:

Warranty Extension - This will automatically double your manufacturer's warranty up to 1 year. I know Visa will actually allow you to purchase warranty extension too if you're interested.

Price protection - If you find your item at a lower price within 60 days, you can get it reimbursed.

Theft protection - If you item gets stolen or damaged within 90 days, you can get reimbursed.

How to make claims:

Friday, March 17, 2006

Friday! Update: Marriage and Hmmm...03.17.2006

Another week has gone by, and the weekend is just starting!!!! What a tough week it was. My urge to smoke again was stronger than it was when I first quit...At times I just wanted to go and buy a pack. I didn't. Yet. I really hope I can keep this up. This blog is really helping. Even if I don't successfully quit, I'm impressed...blogging helps! I guess logging your journey helps. Well, 13 days have passed and I'm $29.25 richer!

Congrats to lamoneyguy! Who's engaged...And take a look at this post and _win_ some contests will ya!

Finally, take a look at this post by SingleMom as she talks about things that make her, and most other people, go hmmm...Good thing I have the weekend to think about them! Have a great weekend everyone!

Thursday, March 16, 2006

Free Northwest Airline WorldPerks Miles

If you're interested....Thanks Slickdeals.net! Get 200 miles pretty easily...Don't worry about getting the wrong answer, it'll give you multiple chances...You can earn additional 2000 if you fly...

http://www.slickdeals.net/#p7214

What $300K Will Buy You In Honolulu, HI

Continuing on the other posts I've seen...

Houston, TX courtesy of AllThingFinancial

Hudson Valley, NY courtesy of Young Professional Financial Blog

Howard County, Baltimore, MD courtesy of Blueprint for Financial Prosperity

Philadelphia, PA courtesy of Tired but happy

Here's what 300K would buy you in Honolulu, HI...a 2 bedroom, 1 bath condo, 686sqft.

Here's what 300K would buy you in Honolulu, HI...a 2 bedroom, 1 bath condo, 686sqft.

Or if you wanted a house, a 4 bedroom, 1.1 bath, 1181sqft.

Or if you wanted a house, a 4 bedroom, 1.1 bath, 1181sqft.

Here's what 300K would buy you in Honolulu, HI...a 2 bedroom, 1 bath condo, 686sqft.

Here's what 300K would buy you in Honolulu, HI...a 2 bedroom, 1 bath condo, 686sqft.

Or if you wanted a house, a 4 bedroom, 1.1 bath, 1181sqft.

Or if you wanted a house, a 4 bedroom, 1.1 bath, 1181sqft.

Why Is Income Such a Big Secret? Part 2

There seems to be a bunch of reasons for not divulging income information ranging from contractual agreements to being boastful to self-pride to being non-anonymous...can I say that? non-anonymous?...to being a little scared.

Terri from Educating the Wheelers goes the non-anonymous route, thus too much info can be inappropriate. And Jose feels it's cultural taboo. I feel that's true too.

Apollo says,

Everyone has an income some a little more then others depending on occupation or business savvy. I suppose we shouldn't value our self worth based on one's income. But given we live in a highly consumerism and materialistic society, it's difficult to ignore sometimes.And John who said,

For me it's an issue w/ pride. I make decent money for someone in my situation, but feel it's not good enough compared to some of my friends and family. I think if more bloggers out there set a trend of revealing their income, I'd feel a little more bold to do so. Maybe you've started something by bringing it up....I think for me it's an issue with pride too...Not only in the sense of how I stack up to everyone else and them to me...I guess it really is a sensitive area...We can always look at our net worth and figure out ways to increase it, our incomes are a little more personal and sometimes outside our control...Maybe it's the fact that we never make enough...so we feel somewhat inadequate? Maybe we should all take the perspective of SingleMom,

I never understood what's the big deal. It's shielded like it's life or death info. If someone knew your salary, what could they do with the information? Tell someone else? Ok, so what?Or we could be in a situation like Kassy, and this topic really becomes moot...since income is not a secret. Maybe one day we can share financial info without the worry of being judged. That'll be the day...It seems like financial blogging is a step towards that direction. Thanks for everyone's input!

Wednesday, March 15, 2006

Paying Taxes With Your Credit Card? Citi Card?

If you are paying your taxes this year with your credit card, there's an offer from Citi you might be interested in. Pay 1.99% in convenience fees instead of the 2.49% charge I normally see. You have to login to your credit card account to see the offer. I'm not sure if everyone has this offer, so don't shoot me. I'm just sharing what I see when I log into my account.

Once you login, you should see a green ad button. If you click on it, it'll take you to the payment site.

Or if you haven't started your taxes yet, you can use your Visa with H&R Block and get the 1.99% convenience fee.

I'm still debating whether to pay with credit.

Here's a general link to pay1040.com and Official Payments Corporation. Of course, here's a link to the official IRS site.

Once you login, you should see a green ad button. If you click on it, it'll take you to the payment site.

Or if you haven't started your taxes yet, you can use your Visa with H&R Block and get the 1.99% convenience fee.

I'm still debating whether to pay with credit.

Here's a general link to pay1040.com and Official Payments Corporation. Of course, here's a link to the official IRS site.

Once you login, you should see a green ad button. If you click on it, it'll take you to the payment site.

Or if you haven't started your taxes yet, you can use your Visa with H&R Block and get the 1.99% convenience fee.

I'm still debating whether to pay with credit.

Here's a general link to pay1040.com and Official Payments Corporation. Of course, here's a link to the official IRS site.

Once you login, you should see a green ad button. If you click on it, it'll take you to the payment site.

Or if you haven't started your taxes yet, you can use your Visa with H&R Block and get the 1.99% convenience fee.

I'm still debating whether to pay with credit.

Here's a general link to pay1040.com and Official Payments Corporation. Of course, here's a link to the official IRS site.

How Much I Saved Up In Loose Change...

For some reason, my car just accumulates coins that go no where. I usually just clean them up every now and then by visiting a Coinstar machine. Well, I went to a Coinstar machine on Monday, and I thought it was interesting...In about 9 weeks I accumulated $20.67. I got an Amazon.com gift certificate so that I don't have to pay the 8.9% service fee. I might start tracking this more...kind of an interesting piece of info to know...

If I saved $20.67 in 9 weeks, that's $2.30/wk. Tack on the $15.75 I save each week from quitting the smokes, and then suddenly that's $18.05 per week! Over a year, that's $938.60...after tax! Not bad...

Why Is Income Such a Big Secret?

I've noticed that most financial blog sites don't reveal income. I thought that was interesting. PFBlog.com writes about why he doesn't do it here.

Bloggers have anonymity, and bloggers can talk about our net worth, yet income is taboo? I'm not quite sure why that is. I've actually debated whether to disclose my income, but having to over come my hesitation on posting my net worth is step 1, I guess. There are some good arguments in favor of posting incomes, such as being able to correlate savings rates to income. Or does posting your income really just "show off"?

In due time, I may post my income. Any opinions on why income is not revealed?

Tuesday, March 14, 2006

I Actually Clicked On an Ad! Smoke Cessation Ad.

So I rarely look at advertisments unless a very unique item is presented to me...well this time, as I was checking how many grammatical and spelling errors I could find in my posts, Google presented me with this ad for "Linkman - The Habit Reversal Device." It was a full image ad, and it worked! This product is interesting, but I'm not convinced it'd work...It's a device that grants you permission to smoke in intervals. The intervals get longer and longer, until finally you're weened off of cigarettes. But hey, an ad that actually convinced me to look at it...Interesting...BTW, just a short update, I haven't gone back to smoking...

So I rarely look at advertisments unless a very unique item is presented to me...well this time, as I was checking how many grammatical and spelling errors I could find in my posts, Google presented me with this ad for "Linkman - The Habit Reversal Device." It was a full image ad, and it worked! This product is interesting, but I'm not convinced it'd work...It's a device that grants you permission to smoke in intervals. The intervals get longer and longer, until finally you're weened off of cigarettes. But hey, an ad that actually convinced me to look at it...Interesting...BTW, just a short update, I haven't gone back to smoking...

New Credit Scoring System...

In case you haven't seen it already, there's an article on usatoday.com about a new credit scoring system...I guess this is a good thing...Does that mean FICO score will be putting on the chopping block?

I thought this was interesting since it gives us a look into a snippet of the credit scoring algorithm. Yeah, a little obvious but hey...

The scores are important because they measure how much debt a consumer is carrying and how well the consumer keeps up with bills.And here's the credit scale:

In a separate statement, Experian said the scores will be grouped on "the familiar academic scale." Experian gave these groupings: A - 901-990 B - 801-900 C - 701-800 D - 601-700 F - 501-600 Experian said it hopes that "as consumers increase their awareness of the importance of credit scores and credit reporting, the consistency of VantageScore will provide the type of information they need to evaluate their credit standing and make sound financial decisions."

Monday, March 13, 2006

Another Funny...Hey, It's Monday!

Hope your Monday is starting out well! Since I found that other strange site, here's a political cartoon for your enjoyment!

JibJab's "2-0-5" George Bush's Year In Review

And another classic, since this is an election year:

JibJab's This Land

Have a good week!

One Of The Strangest Things Ever!

Does this guy make money from this site? Is it creative or just weird? This site contains an animated cartoon with sound: www.badgerbadgerbadger.com. It is kid-safe. I can't get the damn song out of my head now!

A Compromise Between Myself and Myself.

So I've decided. Sort of. :) I'm a victim of my own "mental accounting" issues as It's Just Money describes here. I have fell victim to myself...I feel comfortable knowing that I have money locked away just in case. Just in case of what? My possible but very unlikely house purchase within a year? My possible decision to invest a large amount of money in stocks? Maybe the economy will collapse and suddenly having "cash" will be a good thing. I should change my blog name to Financial Crazies.

Thanks to readers, who voted 7 to 4 in favor of paying off my loan, I've decided what I'm going to do in regards to my car loan. I'm going to pay off at least half. I'm still not sure if I want to pay off the whole loan. Hopefully my loan payment will be reflected by my next net worth update.

0% APR. Just Another Guide.

So you've always wondered about it...you've read about it on a bunch of sites and blogs...you've probably got at least a few offers in the mail...The first time I tried to apply for one of these 0% offers, I was pretty nervous...What if my transfer doesn't go through? Do they always transfer the whole amount? How does it affect my credit rating?

I've done four 0% BT in the past...just one was messed up, you can read about that here.

Points to consider:

- 0% APR on Balance Transfers and/or Purchases?

If it's 0% on both, it's a great deal. Just on balance transfer? Still not bad, just know that you should not be using this card for regular purchases. Just 0% on purchases? Yuck. Beware of the "0% on purchases IF you do a balance transfer" offer from Providian!!

- How many months at 0%?

Longer the better...

- Balance Transfer Fee?

Some have these...if they do, it's usually not worth it.

- Annual Fee?

- Can you get points for transfers?

A bonus, sometimes they give you an offer. Beware though, some will give you points after your first purchase! This conflicts with the next point!

- Are you planning on using this card for purchases after a balance transfer?

If you are planning to use this card for purchases, balance transfers might not be the wisest option. The reason being that when you pay your balance each month, the payment will be applied to your 0% principal while the new purchases will be left accruing interest charges. Each credit card is different in this area, and you should clarify with your credit card company before applying.

- Are you concerned with your credit score? Any big purchases in upcoming months?

If you are, it may be best to skip this offer. Although I'm not sure what the exact impact on my credit score 0% offers have had, I know that last I checked it was still high, above 700. So take it for what it's worth.

Step by step guide:

1. Receive your invitation, and read carefully! Look at the points to consider before moving ahead.

2. Fill out application just like a normal.

3. In the section that asks for Balance Transfer, put your credit card info for the card where you want the funds to go. I usually do this step rather than taking up an offer to have the money sent directly to me. Just in case they try to slip me a cash advance fee.

4. After you have submitted the application, some companies will send you a confirmation. Others may not. I usually check the card where I had the balance transfer done to, which will reflect a payment once the transfer is completed.

5. Log the date the 0% offer will end! In a planner, your PDA, anywhere...just remember to pay it off! Some store credit cards will charge you back interest if you don't pay the balance off before the end of the 0% offer period. Although I've never heard of a "regular" credit card doing that, there may always be a first.

6. If you are not going to use the card for purchases, put it away!

7. Do NOT miss a payment, this could ruin your 0% offer.

8. Save your paperwork and offer letter! Do not throw it away. You may need to reference it in the future.

9. Request check from your credit card company for remaining balance.

10. Place money in high yield account!

11. Congratulations! You've just successfully completed a 0% offer. Just make sure you pay on time.

Some other IMPORTANT notes:

- If you request a larger balance transfer than you are given credit, the balance transfer will go $500 below your credit line. This is what I found happens with Chase. For example, if you transfer $10000, but are given a $7500 credit limit, only $7000 will be transferred with $500 credit remaining.

- Read, and re-read the fine print!

- Save your paperwork! Just in case you need to reference it in the future. Again, save it!

Check out these other write ups on 0% offers...

- MyMoneyBlog

- PFBlog.com

If anyone else has posts, let me know...I can add it here.

Friday, March 10, 2006

Cigarette Sales at 55-year Low!

You know, I don't wish bad things on tobacco companies, and I really believe in a free market. Whether they lied or deceived people, I don't know...I made my choice to smoke, and I have to live with it. I believe that's one of the major problems in society, where we always need to find someone to blame...My belief is that the final blame always comes down to ourselves. We make ourselves better that way. Went off on a tangent...*slaps myself*. Anyway, reading this article, made me grin...

Thanks to Financial Train Wreck and Mike @ The Useless Tree for posting up more support! If I ever miss anyone, let me say sorry up front...I'm not a very organized blogger.

Friday! Update: Smoking, Saving Too Much, and More...

I'm sorry, I have to fess up. I have to come clean...I smoked one. On Tuesday. I debated whether to post about it or not, strange huh? It's a blog, for the most part anonymous, yet I have some hestitation about posting my failure. I still haven't bought a pack and feel pretty good about making it...Thanks to Jose and Gay Finance Blogger for their support. What good does it do anyone to not tell.

I'm considering paying off my loan. If you have some time, can you comment or vote on the poll? I'm very interested to hear the reasons behind your vote...

This week had a number of interesting threads...Bankdeals wrote up a cool tool used to calculate whether it'd be worth it to close out a CD...Check it out!

Congrats to 2million for hitting 10% of his net worth savings goal!

MyMoneyBlog has a very interesting post about the financial habits of couples...Even though I'm not married, it's a thought to consider. Can I ever imagine combining my savings with someone?

What if our financial lives were an open book? How would that change the world? Read this at It's Just Money. It's definitely something to ponder...

Finally, Kirby on Finance posted "Are you saving too much?" Can you believe anyone would _dare_ ask that question?!?! It really is a good one to keep money in perspective.

Have a great weekend!

Thursday, March 09, 2006

Buy 2 Dummies, Get 1 Free @ Amazon.com

If you're interested in the Dummies series of books. Thanks Slickdeals.net for this one.

Amazon has a Buy 2, Get One Free promotion for Dummies Books. There is also a $5 rebate (up to 2 max). With both promotions combined, you can get down to $12 for 3 books. Free shipping.

Should I Pay Off My Car Loan @ 4.25%?

I'll Have That In LARGE (10K) Bills Please.

Uhhh, yeah, I'll take LARGE Bills. Read all about it. I guess Franklins are not the only big boys in town.

Uhhh, yeah, I'll take LARGE Bills. Read all about it. I guess Franklins are not the only big boys in town.

Just a Thought...2 Cent Stamp Worth $0.02?

I just handed over a $0.02 stamp to my friend because she didn't have any, and I thought, "I wonder if these $0.02 stamps actually cost more to make then they are worth?" Didn't they even have a $0.01 "make-up" stamp a few years back?

I think the USPS should start annoucing increases to postage on a certain date, while still allowing folks who have old postage to use it until another certain date, like 1 year after the increase. At which time, people will be forced to buy "make-up" stamps. All retail locations will only be selling the new stamps from the initial date, so that people would slowly move over.

So for example, on Jan 1, 2006, stamps go up to $0.39. However, if you have old stamps, you can use them until Jan 1, 2007. All stamps sold from Jan 1, 2006, will be $0.39. Maybe that's just too confusing? Sorry, just a random thought...hopefully you didn't think that was too much of a waste of your 2 minutes. :)

Major Asset Allocation, But Where? Part 2

So I did more analysis on my current allocations. I took a look at my entire portfolio including my retirement and non-retirement funds, then figured out what percentages were in cash, bonds, and stocks. Here it is:

Combined Total Assets Allocation (retirement and non-retirement)

Cash - $117,943.53 - 58.74%

Bonds - $30,430.50 - 15.16%

Stocks - $52,412.72 - 26.10%

Now I have even MORE allocated to cash. :)

I will continue on the analysis (in future posts)...This is getting more and more confusing.

Previous posts:

- Major Asset Allocation, But Where?

0% Balance Transfer: $21,500 Approved!

Wow, I just decided to go all out on a 0% Balance Transfer offer, and it went through. Well, I actually asked for $25,000, but looks like I could only get $21,500 approved...But wow! I didn't expect that much.

Chase sent me 3 offers, one in December, one in January, and then one in February. Each extending the 0% for up to 15 months! No balance transfer fees. So with the offer in February, I took it. I requested $25k transferred to my Citi card, where I then requested a check for the balance. I always transfer to another credit card from a different company. Why? I don't know actually...I guess first of all, I don't want them to tell me I didn't do a "balance transfer" and second, if it's another company, they can't see if I really have a balance.

Hopefully by my next net worth update, I'll have the cash sitting in one of my accounts...What can I do with $21,500 for 15 months...hmmmmm.

Wednesday, March 08, 2006

PFBlogs.org, Where Are You?

Something must be wrong...maybe the feed to PFBlogs.org? Maybe PFBlogs.org doesn't like me? Maybe PFBlogs.org is having some problems?

Major Asset Reallocation, But Where?

So on May 1, I'm planning on relocating a large portion of my funds into my brokerage. I would like to invest more in stocks, but I'm not sure where. I have so many questions and hesitations...Maybe I should consider a fund? Is the stock market ready to crash? Will housing affect the stock market? How much should I invest?

The reason I've selected May 1, is because the interest rate will most likely be re-adjusted down at HSBC. The feds will also adjust short term rates again by then, giving an indication of where Bernanke stands. Also, the market seems to be in a plateau right now, not moving up or down too much, so I'm not in a rush. I don't forsee any big news, but the expectations/outlook for this year scares me a little.

Based on my net worth analysis from last month:

Cash - $88,813.74 - 44.24%

Stocks - $21,411.86 - 10.67%

Retirement - $90,528.51 - 45.09%

I have $88,813.74, or 44.24% of my net worth, locked up in cash. That's way too much. I'd like to reallocate to something like this:

Cash - $30,000 - 15%

Stocks - $80,300 - 40%

Retirement - $90,528.51 - 45%

There aren't any stocks that really appeal to me at this moment, the closest being JNJ. I should probably breakdown my retirement fund to see how that's allocated. I may need to re-adjust that...I'll do that when I update my net worth for March.

AllThingsFinancial, just had a post on this topic...I really don't know what to do...I have a couple months to figure it out. What to do, what to do...

Puppy Is Okay!

Everything went fine...his stitches were removed yesterday, and he no longer has to wear that cone which he despises. Hopefully his hair will grow back quickly because he looks a little creepy with a patch of hair missing above his eye. He did have to get some new anti-biotics for his skin infection, so I updated my dog costs.

Tuesday, March 07, 2006

No Convenience Charges Allowed...

Didn't know this...I've run into many stores that charge a nice fee if you don't buy over a certain amount and try to use a credit card. This article @ MSNBC has some neat info...check it out.

There are 3 other interesting topics covered, switching cell phone carriers, not receiving a refund and what to do, and finally getting rid of bill collectors, which I hope none of my readers have to experience, but good info to know.

Smoking Update: Day 3

So far, so good...the first day was difficult, and I definitely felt the effects of nicotine withdrawl. I had a small headache and was pretty irritable. It's the 3rd day now, I'm starting to feel better. I did have a couple of periods where I wanted to go buy a pack...but didn't. I also tried not to hang out with my friend who smokes...for obvious reasons :).

Thanks to lamoneyguy, who gave me some good advice, "It's a combination of will power and a change of attitude. The will power alone will never be enough. Like some who decides that today is the day they get out of debt, the change in attitude is most important." And to mbhunter who said, "One way to help you stick with it: Set up a jar or a sub-account, and put the money that you don't spend on cigarettes in the jar. Save half of the money and use the other half to celebrate after you reach a milestone." Two pieces of advice I totally agree with...I need to setup that jar...

Thanks for the support! Having this blog has helped a lot so far...knowing that I can go back and look at something to remind me, gives me a little more oomph to skip that urge. It's awesome! Let's see if I can hit a week.

Monday, March 06, 2006

Free Toothpaste

Thanks to Slickdeals.net. This is an interesting one (okay not really, but still), and I know everybody could use this...It's a rebate offer, up to $3.00, limit 1. Free Toothpaste

Off Topic: Secret To Grilling Steaks

So today is Monday. My local supermarket started this thing where they serve steak lunches, and it is sooooo good! Is it their grill?? They use propane to grill their steaks, but on massive grills the size of a truck bed. It can't be that special. Is it their steaks?? Nope. I've tried it, doesn't taste as good when I grill it. I tried all kinds of different cuts, tri-tip, rib-eye, new york from their meat department. Since that's what they use. So what is the secret??? Well, I finally found out...it's olive oil! Salt, pepper, and coat the steak with olive oil then grill, and the steaks come out amazing! I think I'm going to have steak for lunch. Damn, I should be saving...

Sunday, March 05, 2006

I'm Going To Quit Smoking

04.07.2006 - It's not been over a month! I just hope I can keep this up...what's scary is that even a month later, I still have urges. Man, it's a hard habit to kick. My day 31 update.

03.07.2006 - Smoke Update: Day 3

03.05.2006 - Original Post:

This blog offers me a rare opportunity to try and quit smoking with some accountability. I don't have to tell friends I'm quitting, which is great, because usually that comes with an automatic reply of "rrrriiiight," a sense of disbelief, and then the next topic of discussion for the day. Don't get me wrong, my friends want me to quit, it's just that I've tried so many times.

I started smoking when I was in college, not sure exactly when, but about 8 years ago. I don't recall exactly how I got started, but I do know that I initially just wanted to try. I thought it wasn't that bad, and it gave me a "buzz." That buzz quickly wore off and turned into an addiction. I started off smoking a pack a week, which moved to a pack every 3 or 4 days, and now to half pack a day.

I have to create a benchmark to become a "non-smoker" so I'll use 12 months since Money and Investing mentions that. A pack of cigarettes costs, on average, about $4.50.

My goal: 12 months of no smoking! Of course beyond that, but I have to start somewhere.

My plan:

- Quit cold turkey.

- Update this blog on my progress, not sure how often yet.

- Track my total savings because I quit and the number of days.

My reason for quitting:

- For my health. I want to be able to not only live longer, but enjoy my years living...not breathing heavily just to make it up 10 stairs.

- Get rid of this nasty cough that hangs around all the time.

- Stop worrying about the next time I can smoke.

- Save money.

- Don't smell like an ashtray.

- Just to quit. Damn this habit!

Any words of wisdom? Wish me luck.

Friday, March 03, 2006

Make Money...Playing Online Games

There's no doubt the poker craze has peaked, yet in the murky world of online gambling at least in the US, there's money to be had. The online gaming industry is huge, with some private companies valuations in the billions, in fact, try 4 billion! That's a pretty penny and just one company...imagine an industry valuation.

Since the topic is "online games," there's also selling of accounts like EverQuest and World of Warcraft, but that's another post, part 2, in the future...

The US has been somewhat cold to the idea, but the UK has no problem with it, allowing their citizens to play tax free! In fact, if you're talking about making money, these sites are it..."Deposit $100, and we'll give you $100 free!" How many investments can give you that kind of RoI in a matter of minutes...okay you have to win though! :) And read the fine print! Some require so many hands to be played before you can "cash out."

There are tons of games out there beyond just regular Texas Hold-em, such as Omaha, Omaha hi-lo, 7-card stud, 7-card stud hi-lo, and 5-card stud, each with their unique strategies.

In my college days, I used to play these games quite a bit, usually just to make the bonuses offered and maybe win a couple hands. I have made a pretty penny playing online including freebies like poker chips, card shufflers, poker tables, KEM cards, and other stuff. The lure of playing too much is quite dangerous, and I have to warn anyone interested that you must have a high level of self-control, or don't get involved!

So you want to try it? Well, I would recommend starting off at Poker Source Online (PSO). At this site, you can earn additional freebies on top of normal bonuses given by online gaming sites. Visit the forums and read the reviews about poker sites. PSO does offer a referral program, if you're interested, shoot me an email, and I'll send you a special link.

Here are some sites that I would recommend, each has a review at PSO:

bodog.com

PartyPoker.com

Royal Vegas

The Gaming Club

Absolute Poker

How does it work:

1. Sign up, check out Poker Source Online first, tons of "bonus" offers to be had there.

2. Download their software.

3. If you choose to play "real money" games, then you will need to transfer money to your gaming account. This is the trickiest part. Each gaming site has their own rules, but many require a copy of your ID to open an account. You often get benefits for having a money transfer account similar to paypal to use as well. During the deposit, you'll be shown many of these options, one being Neteller.

3. Play away!

How to make money:

1. Freerolls! These are tourneys that you can play for free. Some require that you play a certain amount of regular hands, others are just a free-for-all register-as-soon-as-you-can tourney.

2. Play table limits you are comfortable with! I've seen many people lose hundreds in a few minutes, and I want to warn you that playing online is as real as playing on the Las Vegas Strip.

3. Limit your time on any given table to 10 or 15 minutes. If hands are not going your way, leave the table and watch TV for awhile.

4. Read, read, read! Strategy guides abound on the Internet. Don't be a "fish" and give your money away.

5. Many sites offer play for fun, non-real money tables...play them. Although, the strategy is quite different with real money, at least you'll get a taste.

6. Above all have fun!

Trade or Sell Your Car, part 2

So I thought I'd compare trading versus selling your car a little further since I wrote a post earlier on this topic.

There are two big sites for comparing used car prices, Kelley Blue Book and NADA Guides. Even though Kelley Blue Book is more popular, I've heard that NADA is the source used by dealerships more frequently.

I will use a fully loaded 2002 Nissan Altima SE as a comparison car. As of the date of this posting, this car has a trade-in value of $16,125 versus a private sale value of $18,800.

Let's say we are in the purchasing a new 2006 Infiniti G35 Coupe 6MT Liquid Platinum with every feature available, MSRP $40,840.00. Wow! I don't think I would ever buy a car this expensive, but hey I'm just using it as an example. Let's assume tax in the imaginary state of Bloggee is 5%.

If you trade-in:

MSRP: $40,840.00

Trade-in: ($16,125.00)

Subtotal: $24,715.00

Tax: $1,235.75

Final total: $25,950.75 (plus license and doc fees)

If you sell private market:

MSRP: $40,840.00

Tax: $2,042.00

Subtotal: $42,882.00

Private sale: ($18,800.00)

Advertising costs: $50.00

Final total: $24,132.00 (plus license and doc fees)

So in the end, you will end up with $1,818.75 more if you sell private market versus trading in. Now, my calculations do not take into consideration the value of your time used to sell, financing charges, and the "value" of peace of mind. Overall though, selling your car on the private market maybe a better option provided you can sell your car at the recommended value.

Thursday, March 02, 2006

Warning: Deceptive Providian 0% APR Offers

I've been had once by a Providian 0% APR offer. I just got another offer in the mail today with the same offer, and I wanted to share my experience so you don't get caught up in it as well.

In most cases, 0% APRs affect new purchases and/or balance transfers for a period of time. Well, in Providian's offer, they offer a 0% APR on purchases if you do a balance transfer. In nice bold letters the offer letter says: Get an introductory 0% APR on purchases when you transfer a balance NOW...But the bold fails to mention balance transfer gets treated to a nice 8.9% APR. The 0% has nothing to really do with the balance transfer. It's the only 0% offer I've seen do this.

After being charged a nice interest charge for the first month, I called their customer service and had to talk to 3 tiers of service representatives, until finally the manager credited my account. I also asked them to close it, because at this point I was very upset. At least they credited the charges back, I guess. Sure it's my fault for mis-reading the offer, but still it just doesn't make sense.

On a side note, I always look out for balance transfer fees before doing a transfer. So far, Providian has been my only bad experience while doing a balance transfer.

I hope to write a post on 0% offers in the near future and my experience. In the meantime, here's a great post @ MyMoneyBlog on 0% offers.

Trade or Sell Your Car

The much hotter topics usually being about whether to finance or pay cash and to lease or buy are always being discussed, but the topic of whether to sell your car on the private market or trade it in is usually not as popular. Mostly because people automatically assume selling private means more money, but that's not always the case. Based on my experience, I have found that trading in your car has a number of benefits usually forgotten:

1. Convenience. No hassle and worries about advertising and letting people test drive your car.

2. Since the value of the trade in gets deducted pre-tax from the final value of your new car purchase, you save on taxes. This can be substantial especially if your trade in is worth more. On a $10,000.00 trade in, in a state with a 5% tax rate, that means $500.00 in additional saving off taxes. Plus you can finance less, if you choose financing.

3. You don't have to worry about someone coming back to your house demanding money if something goes wrong with the car. Even if you are completely honest and disclose everything, there are occassions where problems do arise. It's nice to know you don't have to worry about it.

I should also add one more note, if you sell your car on the private market, some states require you to pay sales tax. I'm not sure how that works, but I believe California might be one of those.

CORRECTION: If you buy a car from a private seller, you are responsible to pay tax, in California at least. So disregard that last statement...that's from a buyer's perspective and shouldn't concern your decision to trade or sell.

Free Smart Money Magazine

Better check this one out quick...don't know when it'll end. Free subscription to Electronic Gaming Monthly, Popular Mechanics or Smart Money Magazines. Smart Money being the probable selection. :)

Thanks to SlickDeals.net: Free Magazine Subscription

Better check this one out quick...don't know when it'll end. Free subscription to Electronic Gaming Monthly, Popular Mechanics or Smart Money Magazines. Smart Money being the probable selection. :)

Thanks to SlickDeals.net: Free Magazine Subscription

USPS and Cheap{er} Shipping - Flate Rate

Did you know that USPS now has a "flat-rate" box? It doesn't matter how much you put in it as long as it fits in the box...It costs $8.10 and includes shipping confirmation if you print online.

If you ship over 2lbs, then this is worth it!

You can even order free supplies, although they have to be in minimums of 25 boxes. The boxes are free, and there are no shipping charges to the US.

Flat rate boxes

Tape, stickers, and other envelopes and boxes

Did you know that USPS now has a "flat-rate" box? It doesn't matter how much you put in it as long as it fits in the box...It costs $8.10 and includes shipping confirmation if you print online.

If you ship over 2lbs, then this is worth it!

You can even order free supplies, although they have to be in minimums of 25 boxes. The boxes are free, and there are no shipping charges to the US.

Flat rate boxes

Tape, stickers, and other envelopes and boxes

Wednesday, March 01, 2006

PFBlogs.org - The Mother Blog

If you're looking for a one stop source of blogging info, check out pfblogs.org. It's simple and contains a link to tons of personal finance, real estate, and investing blogs. It is updated every 30 minutes when this post was written. Imagine if they had live updates, it would be crazy hitting refresh on that site. Well, it is the mother blog. Let's help keep pfblogs.org ad-free! Spread the word, it's a great site, and go check it out!

Housing Bubble Bursting in Hawaii?

A recent article in the Honolulu Advertiser caught my attention. The main reason was because for the first time since March of 2002, the number of days houses sat on the market reached 40. But the second point of interest was that no matter what the market seems to indicate, optimism is prevalent. For example:

Despite the sales slowdown, local economists and real estate experts say sale prices should continue to rise this year but at a more moderate rate of 5 percent to 15 percent, compared with 30 percent last year.Now if the housing market is slowing down, why would housing prices continue to go up? If the market slows, doesn't that mean a decline in prices come along with it? Just doesn't make sense to me.

My Puppy Gets Bit...

This past Saturday, as I took my dog to puppy training class, he got bit by a golden retriever. My dog was on a leash and there were 2 goldens tied down on the grass. They were just laying there...figured they must be friendly since all the dogs coming were for obedience school. Well, even then they are still dogs. No growl or warning from the golden, just a quick strike to the face of my dog. 2 stitches to the upper eye lid, and 1 below...he's okay though. No damage to the eyeball, which is good. He's doing much better now, just hates that cone on his head. Their owner was near the street out of view. He said sorry, but didn't mention anything about reimbursement for the vet bills. Luckily the instructor knows who the owner is...he's the director of the dog program. Anyway, my instructor asked me to give him the bill and a letter, and he'll give it to the owner. The total cost for this incident: $320.00.

Lessons learned:

1. Never let you dog get close to another dog s/he doesn't know when owner is not near.

2. Never leave any dog unattended in an area where other dogs and people may come close.

They grow so fast! He was a crazy, peeing, pooping machine! Now he's much better...Still crazy at times :). Okay, and still a peeing, pooping machine, but at least he knows where to go now.

Free USB Drive